Introduction

Alaska’s economy and Alaskans’ livelihoods were hit particularly hard by the government shutdowns associated with the COVID-19 pandemic, and Alaskans are struggling to recover. But businesses are now open, employment is slowly improving, and oil prices are up, which has resulted in the state’s Department of Revenue substantially increasing its revenue forecast by $2.2 billion over fiscal years (FY) 2022 and 2023. As a new legislative session begins, policymakers must ensure fiscal restraint by not overspending. A repeat of the enormous spending in the early 2010s would harm, not help, Alaska’s economy and Alaskans’ opportunity to work to improve themselves and their families every day.

Need for the Responsible Alaska Budget

Alaska Policy Forum is releasing its second annual Responsible Alaska Budget (RAB), now for FY 2023, to help effectively limit state spending thereby restraining the ultimate burden of government. The RAB represents a strong fiscal rule in the form of a spending limit which should eventually be passed and added to the state’s constitution for spending restraint now and into the future, as has been done in other states. Fiscal restraint allows the state to prioritize the needs of Alaskans without excessively growing the size of government, thus limiting the burden on the private sector where productivity advances improve opportunities for people to prosper today and for generations to come. Given the need to overcome the economic challenges over the last couple of years and excessive spending from 2004 to 2015 in Alaska, the RAB is an essential maximum limit for legislators this session to correct past excesses and leave the state’s savings accounts untouched.

Responsible Alaska Budget Calculation

The 2023 RAB sets a maximum threshold on the upcoming state appropriations based on the summed rate of the state’s resident population growth and inflation, as measured by the U.S. consumer price index (CPI), over the year before the legislative session. This threshold is an upper limit for the enacted budget for all state funds, excluding federal funds, the Permanent Fund Dividend (PFD), and fund transfers.

Figure 1 provides the FY 2023 RAB amount of $6.55 billion from a 4.77% increase based on the key metric in 2021 above the FY 2022 base of $6.25 billion. The rate of growth is from a 0.03% increase in the state’ resident population and 4.73% increase in CPI inflation.

Figure 1: 2023 Responsible Alaska Budget

The FY 2022 enacted budget was $6.25 billion (2.05% increase), which was $70 million more than the 2022 RAB threshold of $6.18 billion (based on a 0.92% increase in the key metric), meaning it was not a responsible budget. This should be corrected in the FY 2023 budget. Due to higher price inflation over the past year in the U.S. and a small increase in the state’s resident population, the FY 2023 RAB grew by 4.77%.

In addition to high inflation, Alaskan policymakers will also be dealing with the temptation of a high revenue forecast, due to increased oil prices and a well-performing Permanent Fund. Alaska’s Department of Revenue estimated a FY 2023 revenue of $8.33 billion (excluding federal funds), which does include revenue for the PFD, an appropriation we do not include in our maximum threshold calculation. A responsible budget passed by legislators will not have additional appropriations simply because of the large revenue number. Instead, limiting the growth of government spending to keep more money in the productive private sector will support increased opportunities for Alaskans to achieve their hopes and dreams while helping those struggling to gain the dignity of work by earning a living.

Historical Alaska Budget Trends

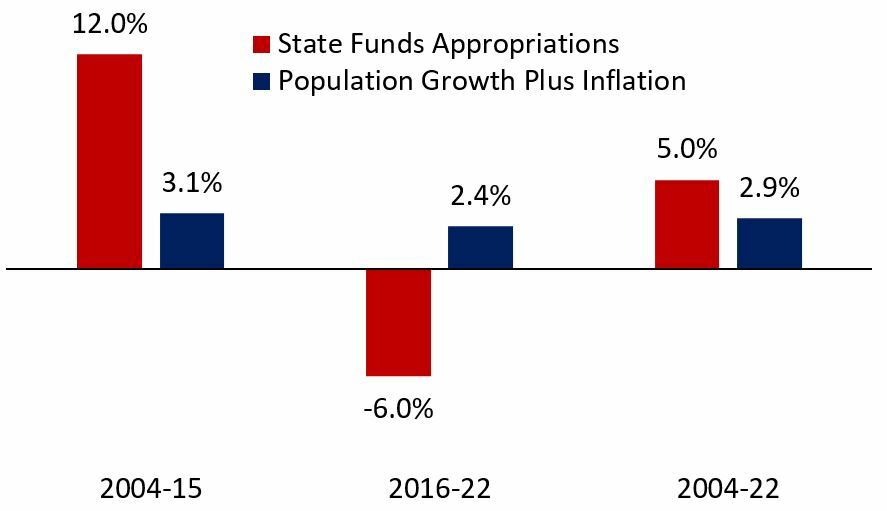

Figure 2 shows the Alaska budget trends since FY 2004. During the period from 2004 to 2015, the average annual budget increased by 12%, which was nearly four times faster than the key metric of population growth plus inflation. Since then, the budget has declined annually by 6%, on average, while this key metric increased by 2.4%, meaning that the recent cutting of the Capital Budget has helped to correct for prior spending excesses. Additionally, these budget numbers are only the enacted budgets, not total state spending.

Figure 2. Alaska’s Budget Versus Population Growth Plus Inflation

Note. Average annual growth rates are based on data from Alaska state budget publications, Fed FRED, and authors’ calculations.

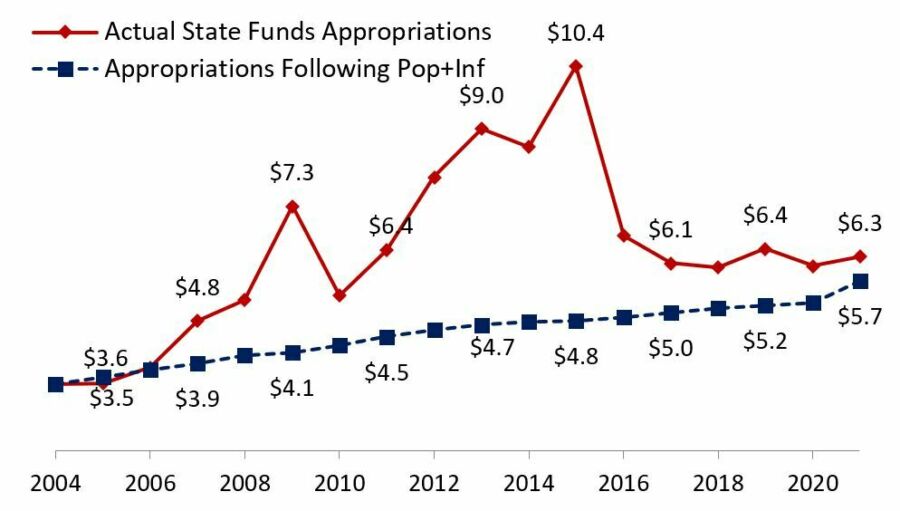

From FY 2004 to FY 2022, the budget grew on an average annual basis by 5%, which was substantially higher than the key metric. Figure 3 illustrates state funds appropriations over this period and the appropriations that would have happened if they had followed population growth plus inflation over time.

Figure 3. Trends of Alaska’s State Funds Budget

Note. Average annual growth rates are based on data from Alaska state budget publications, Fed FRED, and authors’ calculations.

The excesses in the earlier period (2004-15) and the adjustments in the later period (2016-22) have compounded over time to result in an inflation-adjusted state budget per capita in FY 2022 that is 9.4%, or $2.26 billion, higher than otherwise. While the FY 2022 budget is just $537 million above where population growth plus inflation would have it, this translates to the state spending an additional $733 per Alaskan than if the state had followed this key metric. This excessive spending has resulted in a bloated state government that reduces private sector economic activity and opportunities for people to prosper.

Conclusion

Alaska Policy Foundation’s FY 2023 RAB sets a maximum budget threshold that will help bring the state budget in check at a state appropriation of $6.55 billion, representing a 4.77% increase based on population growth plus inflation in 2021. Working to enact a budget less than this maximum amount will help immensely in reducing the cost of funding limited government. Policymakers should pass a FY 2023 budget that is less than the Responsible Alaska Budget and put this spending limit in law. Doing so will move the Last Frontier into the future, with a strong, steady economy and a vibrant population with opportunities for Alaskans across the income spectrum to flourish.

By Quinn Townsend, policy manager at Alaska Policy Forum, and Vance Ginn, Ph.D., chief economist at Texas Public Policy Foundation in Austin, Texas. Ginn served as the associate director for economic policy at the White House’s Office of Management and Budget (OMB) during the Trump administration, 2019-20.