The way we levy and raise property taxes is not just unsustainable, it is unethical. Texans are being forced out of their own homes by insatiable local governments looking to squeeze every dime out of taxpayers. Texans literally can’t afford for the Legislature to wait years to address the issue or make small changes to the system. More than 70% of Texans say property taxes are a “major burden for them and their family” and want relief now. It’s time for bold action.

Lower Taxes, Better Texas* is a two-pronged approach that immediately cuts property taxes nearly in half and redesigns our system to protect taxpayers, provide a fairer tax system, and grow our economy. The plan not only gives taxpayers immediate relief, but it also makes structural changes to our system that prevent year-to-year spikes in tax bills, allow for a more equitable and transparent form of taxation, and rein in irresponsible local government officials.

Lower Taxes

The first prong is to cut property taxes nearly in half. The state can do this easily by eliminating school district maintenance and operations (M&O) property taxes and use state surplus funds above the state’s new spending limit to provide state tax cuts.

Better Texas

The second prong is to modify our tax system so Texas can raise what it needs to fully fund priorities, increase transparency and fairness, and improve taxpayer protections that guarantee reckless local governments cannot continue to game the system.

There are two modifications:

■ Broaden the sales tax base of 51.3% to equalize the tax treatment of certain goods and services, such as legal and financial consulting, and lower the total state and local sales tax rate to 8.21%, which includes a 7.13% state rate and a reduced revenue-neutral local rate cap of 1.08% because of the broader base.

■ Impose a total revenue (sales taxes + property taxes + other local revenue) limitation on local governments similar to the state’s new spending limit, which can only be exceeded by voter approval to raise property taxes on existing property, and require local surplus funds to provide local tax cuts.

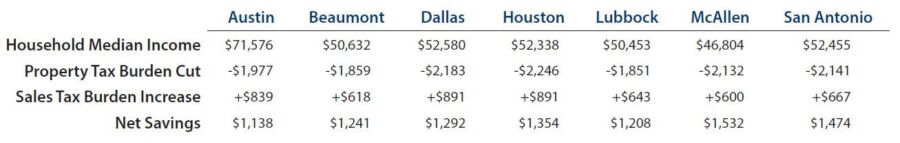

The Results

■ Texas families will see a dramatic tax burden decrease, especially lower-income earners.

■ More money in Texans’ pockets will improve our economy.

■ Local governments cannot game the system to punish taxpayers and push tax revenue to unsustainable levels every year.