Texas taxpayers are eager for the start of the next legislative session so that policymakers can tackle 2 big things next session: property tax relief and property tax reform. The former refers to lowering tax bills while the latter speaks to keeping them down.

When considering tax reform, there are 3 major areas to take into account. The first is the maintenance and operations (M&O) tax, which, as the name suggests, is “used primarily to pay for the day-to-day functions of government.” This most often funds things like salaries, supplies, and services. Second, there is the interest and sinking (I&S) tax, which is used “to pay bonds, including interest, to finance capital projects such as buildings, facilities or other infrastructure.” Think government debt. Lastly, there is a category of indirect reforms that, if implemented, could have a profound impact on the property tax system, as one might imagine with the institution of a local expenditure limit. The I&S and indirect reforms will be discussed in a separate article.

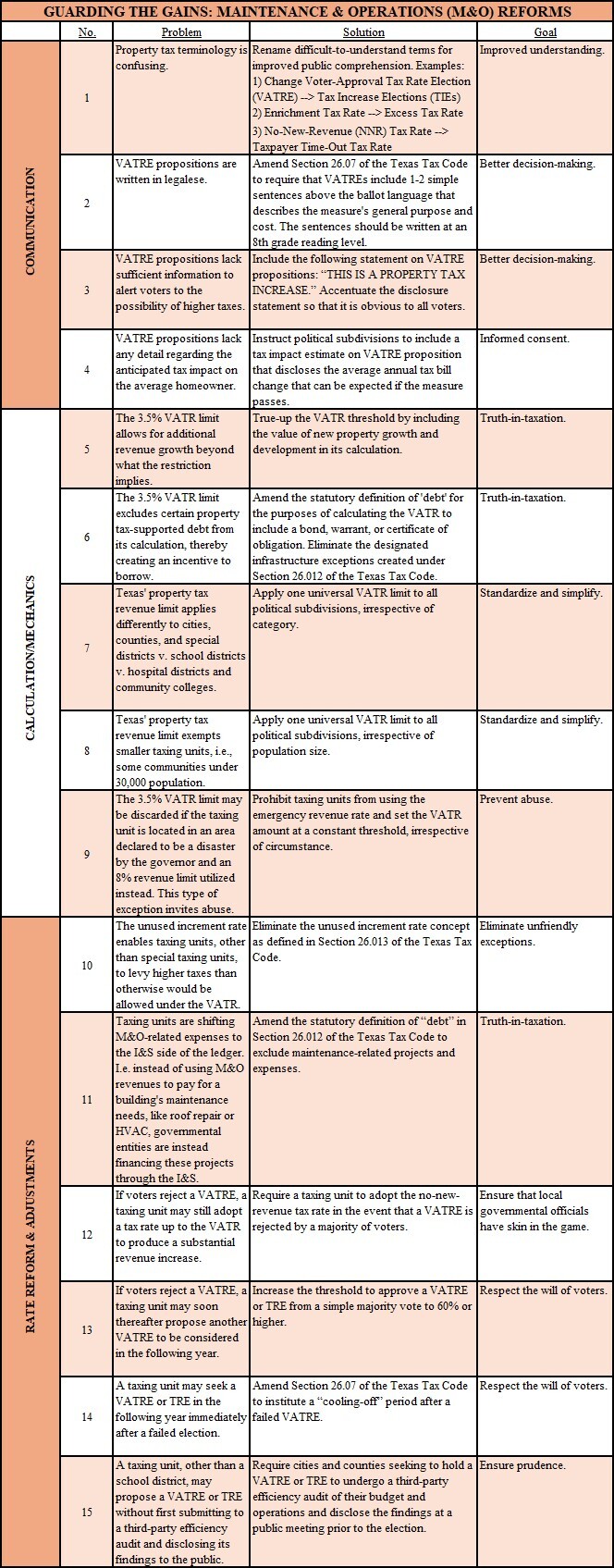

This brief commentary is specifically concerned with M&O reforms and provides 15 ways that policymakers can improve the current system. The reforms are divided into 3 groupings, i.e. those related to communications, those having to do with its calculation and determination, and those pertaining to rate considerations and some of the more mechanical aspects.

Reforms of this type are critical to controlling the growth of governments’ day-to-day expenses and ensuring that they do not drive property tax bills too quickly without informed voter consent.