Later today, the Texas House will take up and consider its version of the 2026-27 state budget, which promises to be quite a long and interesting affair consider that almost 400 amendments were filed.

In anticipation of that debate, it’s helpful to see where things stand numbers-wise.

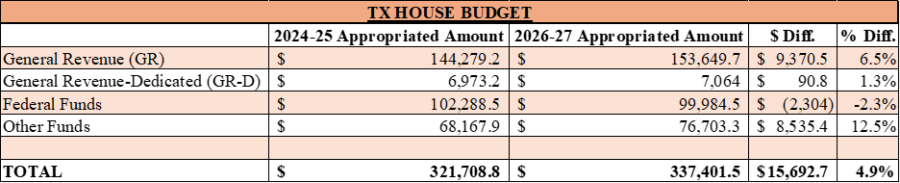

For its part, the Texas House’s proposed budget appropriates $337.4 billion in total which, if adopted, would represent an increase of $15.7 billion or 4.9% from the previous General Appropriations Act. This recommended expenditure level includes “$6.5 billion” in new funding for property tax relief. As may be seen in the figure below, state funding sources (GR, GR-D, and Other Funds) generally increased by some modest measure while federal funds decreased slightly, stemming from the expiration of pandemic aid expiring and other factors.

Figure 1. House Committee Substitute for Senate Bill 1

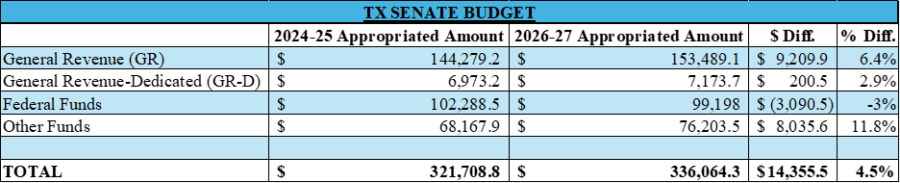

Of course, the Texas House is not the only chamber to propose a budget. The Texas Senate also has its version, which is relatively similar in its overall dimension. For the 2026-27 biennium, the upper chamber has proposed to spend a total of $336.1 billion. Were the budget to remain at this level, then it would represent an increase of $14.4 billion or 4.5% from last session’s appropriated total. The Senate’s version of the budget includes “$6.0 billion” in new funding for property tax relief. As with the House’s proposed budget, monies appropriated from state sources (GR, GR-D, and Other Funds) experienced a modest uptick while federal funds dipped slightly.

Figure 2. Committee Substitute for Senate Bill 1

For some final bit of context, it’s helpful to understand these proposed spending levels in relationship to expected population and inflation (P&I) increases. In November 2024, the Legislative Budget Board received a sample of projected P&I changes from the current 2024-25 biennium to the 2026-27 biennium. The 4 entities provided a narrow range of estimates with a lower bound of 5.88% and an upper bound of 6.55% (see Table 3 below).

As things stand currently stand, the Texas House and the Texas Senate’s proposed budgets are both below this P&I threshold by a reasonable amount.