Ideally, an inverse relationship exists between property tax rates and property values. As one goes up, the other should come down, lest the product of those two variables—i.e., one’s tax bill—shoot up as a result.

Of course, Texas’ local governments aren’t well-known for lowering rates when values rise, or vice versa. Case-in-point: the city of Austin.

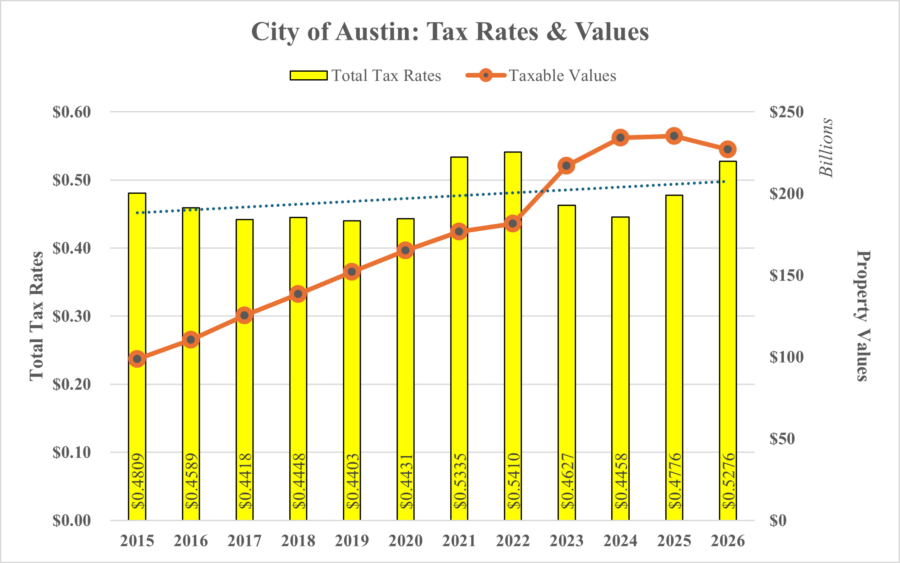

Included in Austin’s latest proposed budget is a host of interesting data related to the city’s property tax, including total tax rates (i.e. the sum of the maintenance and operations tax rate plus the interest and sinking tax rate) as well as property valuations.

Looking at the data tells a story that just about everyone about Austinite already knows.

Over the past 12 years, the city’s total tax rate has been upwardly inclined, growing from $0.4809 per $100 of value in 2015 to as much as $0.5276 per $100 of value in 2026. It’s worth noting that the 2026 tax rate has not yet been adopted. There’s been plenty of fluctuation in between, but if one were to measure endpoint-to-endpoint, then the total tax rate appears to be poised to increase by roughly 10%.

At the same time that tax rates have been inching up, property values also rose. Big time.

In fact, from 2015 to 2026, taxable values in the city grew from $98.7 billion to $227.1 billion, which equates to a 130.2% increase.

As a consequence of rates and values going up simultaneously, tax bills are up quite a bit.

In 2015, the average Austin homeowner could expect to pay $973 in city-related property taxes (NOTE: This does not include taxes levied by the county school district, or special districts). Today, the average resident’s tax bill will approach $2,124.35. Unadjusted for inflation, that’s a 118.3% increase in the burden of Austin city government.

That is the sort of tax bill growth that is propelling Central Texas’ affordability crisis, and it’s another piece of evidence indicating the need for a stricter property tax revenue limitation to prompt fiscal discipline and taxpayer consideration.