There’s an old saying that a good beginning makes a good end. Such will hopefully be the case when the dust settles on the state budget.

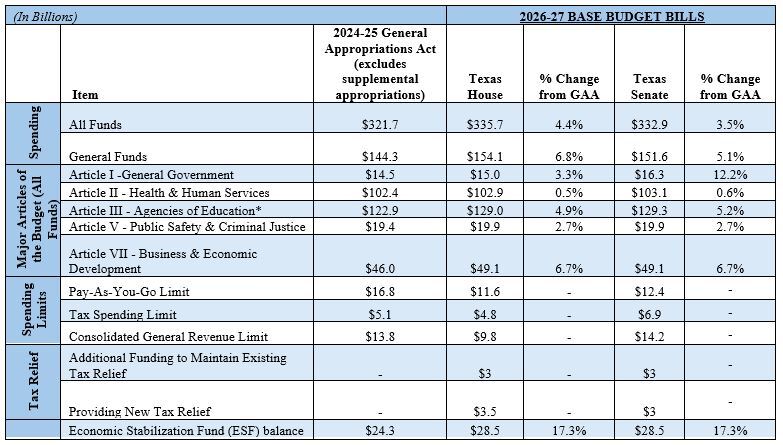

On Wednesday, leadership in the Texas House and the Texas Senate introduced substantially similar base budget bills that included a raft of praiseworthy elements. For instance, both proposals held spending growth below population and inflation, which is a key indicator of a Conservative Texas Budget. Further, each spending plan also included new money for new tax relief. Admittedly, the exact amount of new tax relief and the form it ultimately takes may change over the next few months; but it’s clear that taxpayers are certainly on the minds of House and Senate appropriators. Further still, both chambers made it a priority to fund key conservative priorities, like establishing education savings accounts (House: $1 billion/Senate: $1 billion) and border security (House: $6.5 billion/Senate: $6.5 billion).

Overall, the introduced budgets offer encouragement to fiscal conservatives worried about the potential California-zation of Texas. They demonstrate a renewed commitment to the low tax, limited government model that has long guided state decision-making. Can the spending plans be improved? Always (Hint: More tax relief!) But as the data suggest, these are sound proposals to start.

Now the hard part begins: ensuring that policymakers hold the line and resist the temptation to grow government much beyond these early markers. Let us remember, every extra dollar they spend is one less dollar available for added tax relief.

* Includes funding for both k-12 public education and higher education.