On Tuesday, Texas voters overwhelmingly approved Proposition 4, a constitutional amendment to increase the residence homestead exemption for school district purposes from $40,000 to $100,000. With 99% of precincts reporting, voters approved of the measure by a margin of 83.4% vs. 16.6%.

The passage of Proposition 4 cements the Legislature’s $18 billion tax relief package, which centered on two key provisions—an approximate 20-cent rate reduction for ISDs and the aforementioned homestead exemption increase. With those two elements secure, Texas taxpayers are set to enjoy “the largest property tax reduction in the world,” according to longtime property tax champion Sen. Paul Bettencourt.

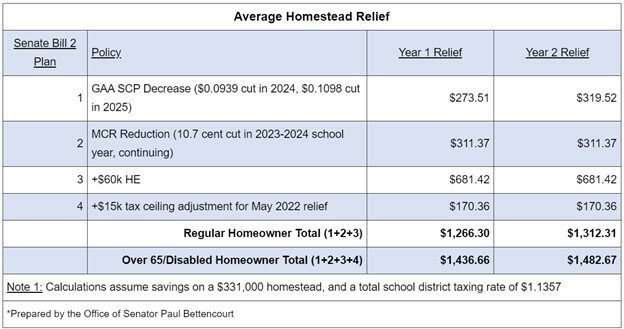

How much of a reduction each individual will enjoy varies somewhat depending on property type, exemptions, valuation, FY 2024 adopted tax rates, and the success or failure of any recent bond elections and VATREs. Still, the average homeowner can expect significant savings and soon.

According to Sen. Bettencourt’s office, the owner of a home valued at $330,000 may see his or her tax bill decrease by $1,266 in year one and $1,312 in year two. For elderly and disabled homeowners with a similar property, the savings are anticipated to be even higher at $1,437 in year one and $1,483 in year two. Again, each property owner’s individualized savings may vary depending on other factors; but even still, meaningful tax relief is on the way.

So take a bow, Texas. You earned it.