In 2019, the Texas Legislature passed House Bill 477 into law in an attempt to improve debt transparency (something sorely needed given our fiscal condition). One of the new law’s chief features is the creation of a Voter Information Document (VID), an educational tool that taxpayers can use to learn about newly-proposed debt measures.

In short, political subdivisions with more than 250 registered voters are required to create a VID for every bond proposition and, according to the House Research Organization, it must disclose the following:

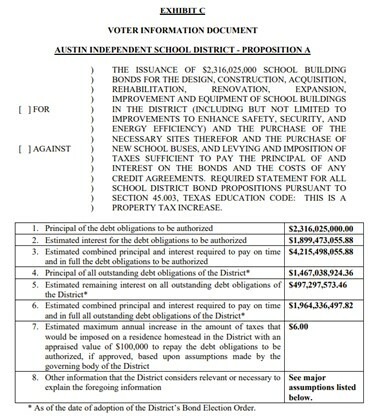

- The language that would appear on the ballot;

- A table with the principal, estimated interest, and estimated combined principal and interest required for full payment of the proposed bonds and the principal, estimated interest, and estimated combined principal and interest required for full payment of all outstanding bonds as of the date the political subdivision adopted the debt obligation order;

- The estimated maximum annual increase in taxes that would be imposed on a residence homestead with an appraised value of $100,000, based on certain assumptions made by the governing body of the political subdivision detailed in the bill; and

- Any other information considered relevant or necessary to explain the other in the document.

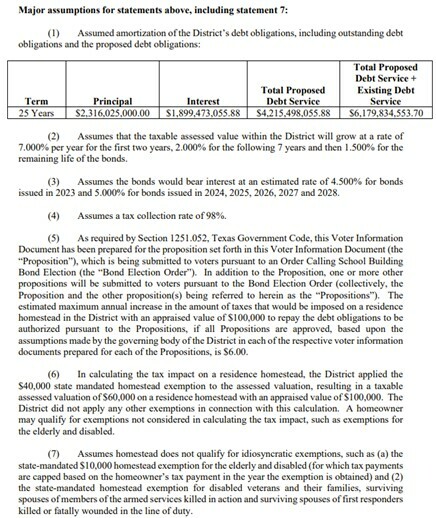

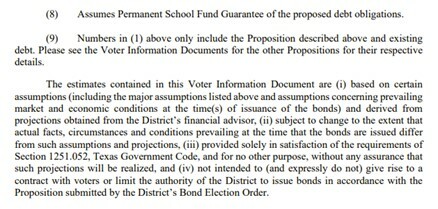

Here is an example of what a VID looks like. The images below capture Austin ISD’s VID for its $2.3 billion bond proposition (the largest in the state!) package as well as the underlying assumptions used to generate the estimates [NOTE: The images only pertain to Proposition A. Information specific for Propositions B and C are found elsewhere in this document]. This is the sort of information that voters should understand prior to casting their vote.

To be fair, the Voter Information Document isn’t perfect. As you might have seen from the images above, governmental entities are using rosy and questionable assumptions (see value growth, interest rates, and the application of the homestead exemption to name a few). Others, like Plano ISD, aren’t showing their work at all (which seems to at least contradict the spirit of Section 1251.052 (c) of the Texas Government Code).

Even still, the VID is a good tool that every taxpayer ought to be aware of right now and putting to use to make informed decisions. Come next session, let’s hope Texas lawmakers take the opportunity to shore up its weak spots and make it even more useful going forward.