Austin home prices are soaring.

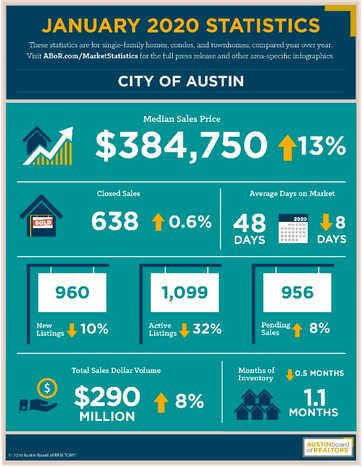

According to new figures released by the Austin Board of Realtors, the median price for a home inside the city limits rose to an eye-popping $384,750 in January 2020. That’s a year-over-year increase of 13 percent, signaling an incredibly hot market.

Source: Austin Board of Realtors

But that’s not the only thing up. Tax rates are also rising.

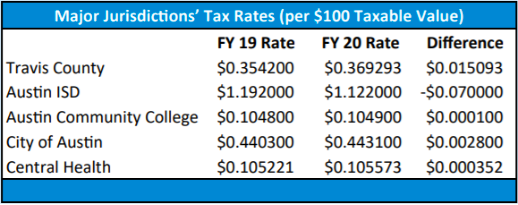

In fact, most major jurisdictions in Travis County raised their property tax rates from fiscal year 2019 to fiscal year 2020, per the county’s FY 2020 Budget in Brief. Only Austin ISD lowered its tax rate, though it doesn’t deserve the credit. Per the district’s website: “This reduction is due to the 93% tax compression as passed by House Bill 3 of the 86th Texas Legislature in 2019.”

Source: Travis County Fiscal Year 2020 Budget in Brief

The fact that both home prices and tax rates are rising is troubling. To be clear, a home’s sales price isn’t the basis for determining a person’s tax bill (that’d be the role played by your appraised value). But clearly the market is on the move—big time. And it’s against this backdrop that Austin-area governments are raising their tax rates, when they should be lowering them. That’s not good news for current or prospective homeowners.