Austin is in throes of a pronounced affordability crisis, with the area recently ranked as “one of the least affordable cities in U.S. for minimum-wage renters.” Even still, the crisis isn’t stopping Austin-area governments from raising taxes.

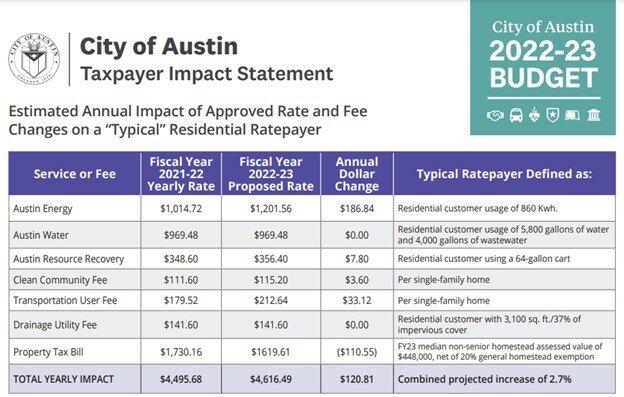

Last week, Austin’s city manager unveiled a new budget $5 billion budget that includes “a $500 million increase from last year and a property tax increase up to the state-set 3.5 percent cap.” If adopted, the proposed budget would force Austinites to pay higher taxes and fees. In the current fiscal year, the average Austinite paid a total of $4,495.68 for city services. In the coming year, that total may grow to $4616.49, representing a 2.7% increase at a difficult time.

For homesteaders, the city’s tax burden is—thankfully—expected to decrease by a small amount. Here’s more explanation from the city’s proposed budget (see pg. 159):

“The median assessed value in Austin of an owner-occupied home, or homestead, not receiving the property tax exemption for seniors or the disabled is projected at $448,000 in fiscal year 2022-23. After incorporating the effect of the City’s general homestead exemption of 20% of assessed value, applying the proposed property tax rate to this median home value yields an annual property tax bill of $1,619.61. This represents a net decrease of $110.55 from FY 2021-22, when the median assessed homestead value of $399,760, 20% homestead exemption, and property tax rate of $0.5410 yielded a property tax bill of $1,730.16.”

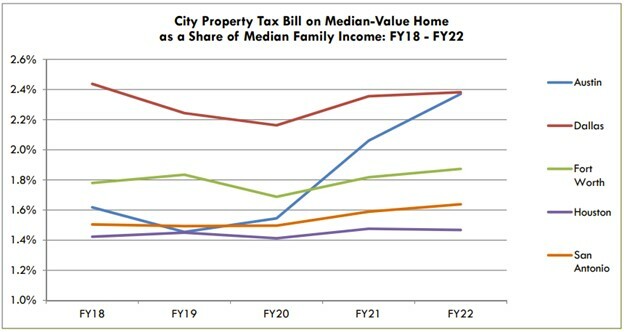

While this welcome news to some degree, it’s important to remember that city property tax bills have weighed more and more heavily on homeowners in the recent past, especially as compared to other large Texas cities. The city’s own data (see pg. 159) show that “residents’ ability to pay their tax bills…[as illustrated by] the percentage of median family income that a resident who owns a median-value home pays in property taxes” has increased significantly over the past three fiscal years.

Concerns over Austin’s crushing tax burden are nothing new, of course. Earlier this year, the Foundation published a detailed analysis showing that from 2016 to 2020, the city’s property tax levy grew from $559.5 million to $949.8 million, representing a 69.8% increase. By comparison, its population grew only 2.4% over the same period and inflation rose just 7.8%. What this clearly illustrates is that the city’s burden grew far faster than it should have. And while the tax levy is only expected to increase by 3.5% this year, tax bills still remain swollen from past years of excess.

The cost of government continues to heighten Austin’s affordability problem, punishing existing property owners and pricing out potential newcomers. We must get this problem under control to ever really get a handle on the problem.