The start of 2019 has our families and yours determining budget priorities. If you look at your budget, you get a good understanding of what you prioritize most. This also happens with the state’s budget.

Let’s review the legislative priorities set by the Texas House and Texas Senate in their recently proposed recommended budgets and how those compare with the budget limits supported by 18 organizations in the Conservative Texas Budget Coalition.

Of course, there will be many discussions over these budgets during the next several months until a final budget is determined and approved by both chambers near the end of session. But these recommendations give an indication of the priorities of each chamber, much like your family’s budget.

Both chambers have prioritized, with different emphasis, public education and property tax relief. Both chambers have budgeted relatively large increases of funds to public education, but the details will need to be worked out to determine the allocations of taxpayer money to these priorities.

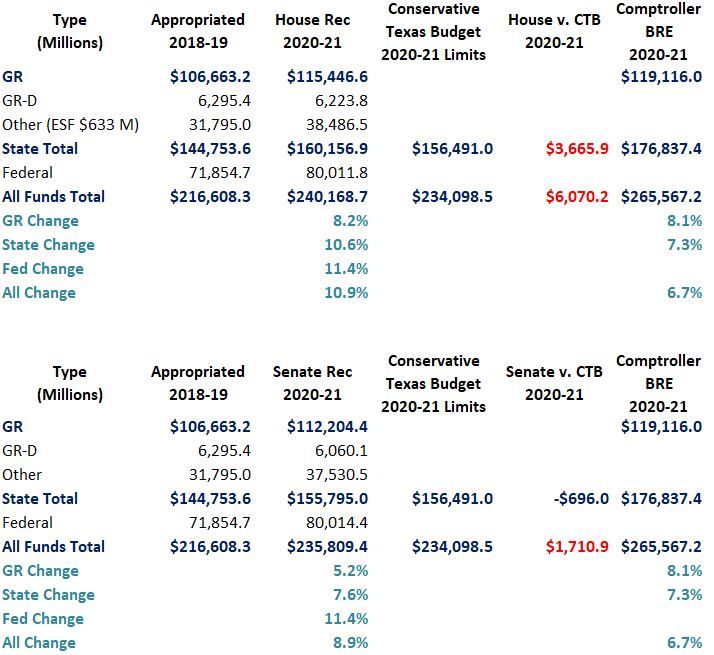

Table 1 provides the House and Senate recommendations for the 2020-21 budget.

Table 1: Texas Budget Recommendations Compared with the Conservative Texas Budget

For an apples-to-apples comparison of appropriations, the amounts appropriated for the 2018-19 budget are from the Legislative Budget Board’s (LBB) Fiscal Size-Up. We compare each chamber’s recommendations with the Conservative Texas Budget (CTB) limits for state funds and all funds (state and federal) based on the increase of 8 percent in population growth and inflation in the last two fiscal years. We’ve excluded from these budgets, including the CTB, the Harvey-related disaster recovery expenses of $7.1 billion in federal funds because these should be one-time, unwarranted expenses.

We’ve also included the Texas Comptroller’s Biennial Revenue Estimate (BRE) amounts that the Legislature has available. Consider, too, that the LBB set a spending limit this session on general revenue not dedicated by the Constitution of 9.89 percent. As discussed during the Board meeting, this growth rate is based on population growth and inflation of 8.39 percent—second session in a row using this metric instead of personal income growth—and Harvey recovery funding of 1.5 percent.

Now to the comparison of these budgets.

The House budget amounts of state funds and all funds exceed the CTB limits and use $633 million from the Economic Stabilization Fund (ESF). These amounts should be addressed during session and decreased below the CTB limits. The indication of the priority of public education and property tax relief comes at the tune of $9 billion in additional state funding toward these, contingent on bills passed for each during session. While the specifics will be determined during the legislative process, taxpayers should be made a priority by using funds to lower property taxes while assuring current resources to public education are being prioritized in the classroom.

The Senate budget amount of state funds is fortunately below the CTB limit but the amount of all funds is above this limit because of an expected federal funds increase, and no use of the ESF. The amount of all funds should be reduced where possible to lessen dependency on federal funds and put the budget under the CTB limit. The Senate also prioritizes public education and property tax relief with $6 billion separated specifically into $3.7 billion for increased pay of $5,000 per teacher and $2.3 billion for an undetermined form of property tax relief. As with the House budget, the Senate should put taxpayers at the top of the priority list with maximum dollars toward property tax relief while allocating current resources to public education more efficiently with policies such as merit-based teacher pay. Ultimately, these recommendations are just the starting point. Currently, the Senate budget appears in better shape compared with the CTB limit in state funds and doesn’t include use of the ESF. But the House could potentially provide a larger amount toward property tax relief while using primarily current resources to more efficiently fund an improved education system.

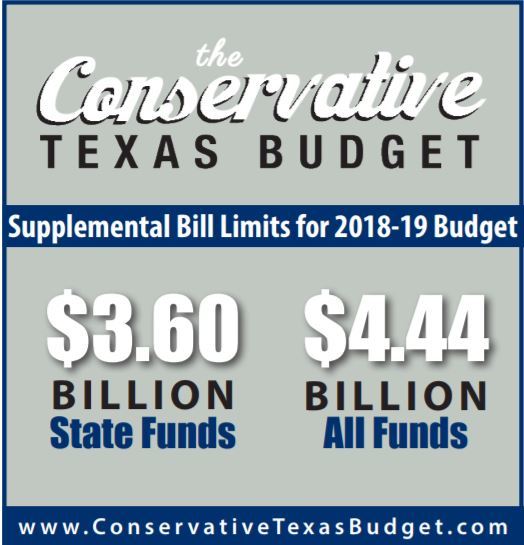

There’s also the need to sustain the 2018-19 CTB based on the supplemental limits below.

The Senate’s supplemental bill to cover amounts due for the 2018-19 budget period shows the amount in all state funds is $4.2 billion including $2.5 billion from the ESF with “over $1 billion” for disaster recovery funds for Harvey-related expenses. So, even with money for Harvey the supplemental bill is below the CTB limit for all funds and without the over $1 billion in state funds is well below the CTB limit.

Given the cautiously optimistic BRE by Comptroller Hegar and the amount of inefficiencies in public education spending, there should be a push to use as much taxpayer money as possible to do what Texans demand and eliminate property taxes. This should start by slowing the growth of government spending and using additional dollars to put the school maintenance and operations property tax on a path to elimination, as outlined in TPPF’s property tax proposal (view how much you could save over time with our online calculator below).

property tax

bill:

Bottom line: There’s more work to do to limit government spending and provide tax relief to let people prosper. Achieving the third straight CTB and lowering taxes will support a more prosperous Texas.