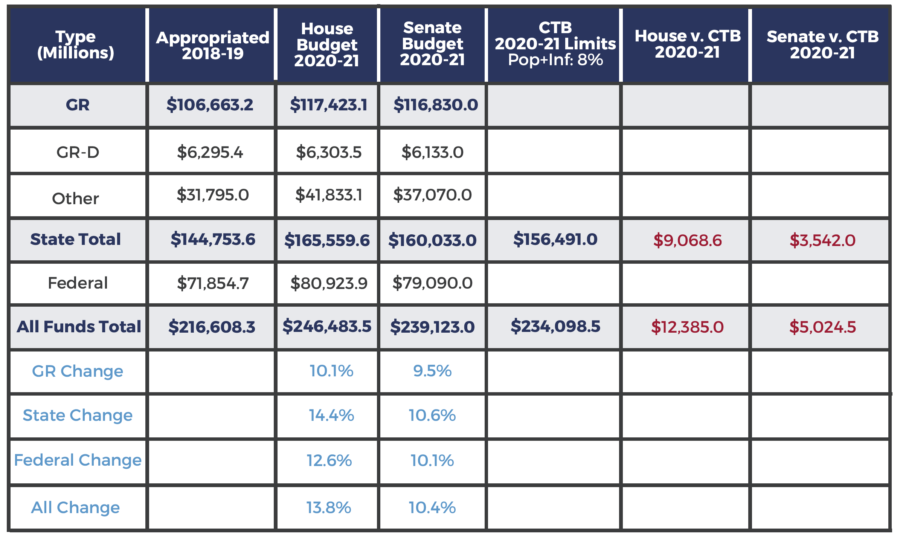

Conservative Texas Budget: $234.1 Billion

House Budget: $246.5 Billion ($12.4 billion over)

Senate Budget: $239.1 Billion ($5 billion over)

Legislature’s 2020-21 Budgets

The table provides an apples-to-apples comparison of funds appropriated for the 2018-19 budget from the Legislative Budget Board’s Fiscal Size-Up and the House’s and Senate’s versions of the committee substitute for House Bill 1 (CSHB 1) for the 2020-21 period. Both chambers’ versions of the budget include any money in their respective supplemental bills for that period.

Excludes Harvey Recovery Money

We exclude from both chambers’ 2020-21 budgets the designated Harvey recovery expenses of $8.3 billion because these should be one-time expenditures.

Conservative Texas Budget

We compare the Senate’s budget with the Conservative Texas Budget (CTB) limits for state funds and all funds (includes federal) based on an increase of 8 percent in population growth and inflation over the last two fiscal years.

Comparison Results

Both chambers’ budgets exceed the CTB limits in state funds and all funds. Even if the $2.7 billion currently designated to property tax relief in both budgets was excluded from the spending limit, they would exceed the CTB limits and provide little-to-no tax relief.

Recommendation

The Legislature could get below the CTB limits by repurposing the $2.3 billion tentatively allocated to public education and the $2.7 billion currently dedicated to generic property tax relief to lasting property tax reductions beginning in the 2020-21 biennium. In order to be exempted from the CTB spending calculations, the $5 billion would have to be used to buy down school property taxes using a mechanism similar to the one outlined in the Foundation’s plan: Abolishing the “Robin Hood” School Property Tax.