The city of Fort Worth may soon raise taxes on residents, despite just publishing a study aimed at tackling its brewing affordability crisis.

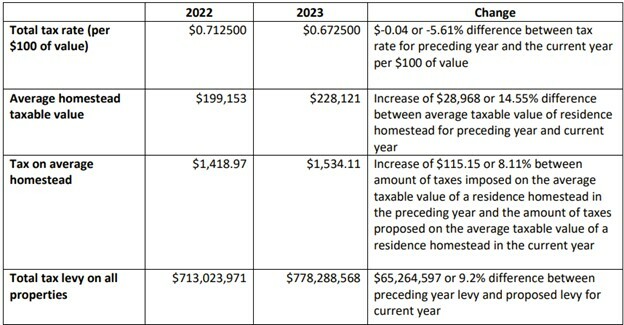

According to the city’s Notice of Public Hearing on Tax Increase, a public hearing is set for Tuesday, September 19, 2023 to discuss its proposed tax rate for the upcoming fiscal year. Right now, the tax rate that will be considered is $0.6725 per $100 of value, which is slightly lower than the current year’s tax rate, $0.7125 per $100. Despite the marginally lower rate, it’s not enough of a decrease to offset property value growth, which is reported to be “10% to 20% this year.” The combination of a slight rate reduction and significant property value growth will likely produce a significant tax increase.

For example, assuming city hall adopts the proposed tax rate, the owner of a $228,000 home can expect to see their city tax bill jump by $115 per year or more than 8%. The overall tax levy (which encompasses the full weight of the city’s property tax burden) is projected to grow by more than 9%.

Asking the average homeowner to bear an 8% increase in the cost of city government is a big stretch today. But what makes Fort Worth’s pitch all the more baffling is that the city just published a report, Neighborhood Conservation Plan and Housing Affordability Strategy, detailing the plight of its residents. Consider this observation (from pg. 51):

“In very low income areas, the median assessed value of a single family residential property increased 58 percent from 2016 to 2021, or about $35,000 from $60,360 to $95,295. Citywide, the median assessed value increased 44 percent, or about $67,000 from $152,625 to $219,431.”

Such valuation increases would not be an issue if the city had consistently adopted smaller and smaller tax rates. But, of course, they haven’t and, as a result, the city’s tax burden has grown steadily. These persistent tax increases now endanger the community’s most impoverished. More from pg. 51:

“Rising home assessments present a risk for families on fixed incomes who may not be able to afford rising property taxes and the cost of fixing up deteriorating homes.”

It’s not just homeowners contending with the affordability issue either. The city’s report also notes the toll on renters. From pg. 47:

“Rents in Fort Worth increased 22.8 percent since March 2020…This is placing an extreme burden on low- and middle-income households across the city to find safe affordable housing.”

The report even quantifies how many renters are struggling to afford rent. From pg. 38:

“According to the US Census, about 32,000 low income households in Fort Worth pay more for rent than they can afford, a situation that is referred to as being ‘housing cost-burdened.’”

Considering that homeowners and renters alike are struggling to afford their bills today, how then does it make sense to propose a nearly double-digit tax increase?