Benjamin Franklin said “By failing to prepare, you are preparing to fail.”

It makes sense to prepare for the unexpected. That was the purpose of Texas’ Economic Stabilization Fund (ESF), also known as the state’s “Rainy Day Fund.” But there are efforts this session to abuse the ESF by excessively growing government.

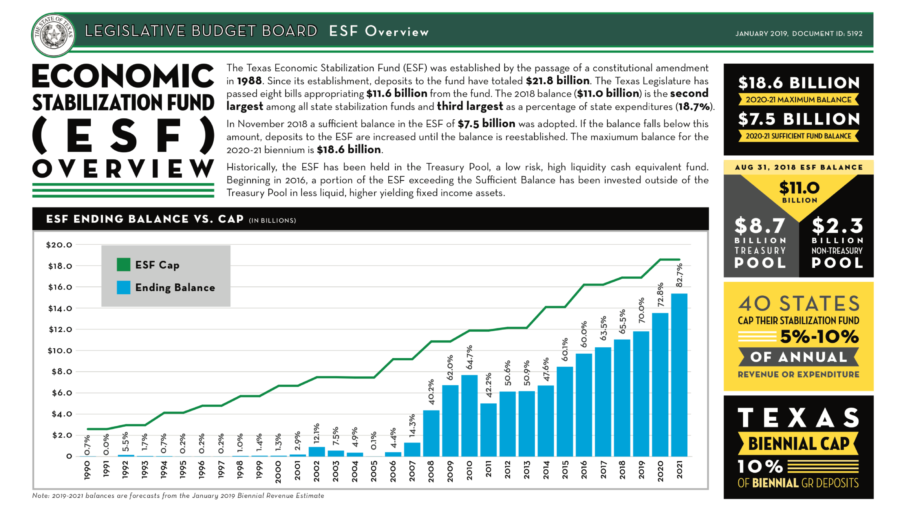

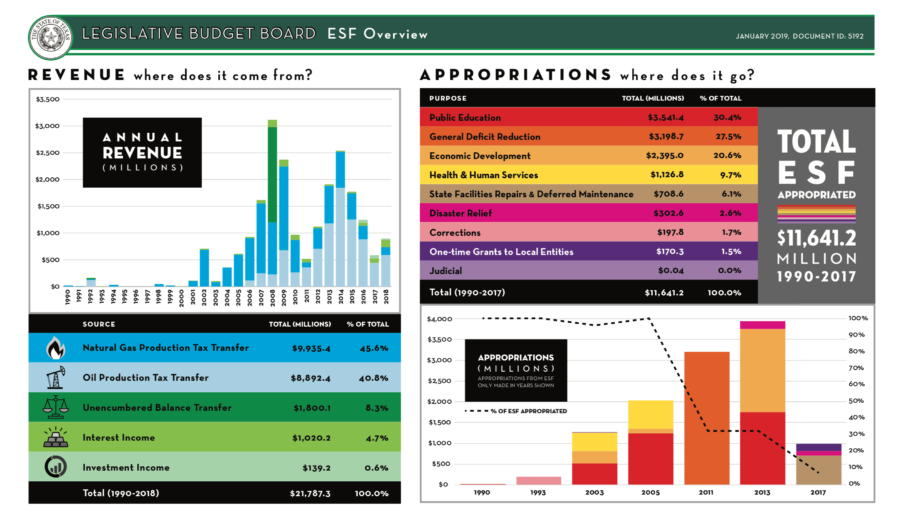

The ESF receives money primarily from severance taxes paid on oil and gas production and some from state surpluses over time. Its sole purpose for these funds is to “be used to offset unforeseen shortfalls in revenue,” according to the ballot language approved by the voters in 1988. The Texas Comptroller’s Office reports that the balance at the end of fiscal year 2019 could be around $15.4 billion, excluding any expenditures from it.

In 2017, Texas was hit with a costly natural disaster in Hurricane Harvey, bringing devastation to many Texans along the Gulf Coast. And in the House’s and Senate’s versions of this session’s supplemental bill, the Legislature has rightly appropriated money from the ESF to Harvey recovery efforts.

However, the ESF appropriations don’t end there, which raises questions as to whether or not the Legislature has forgotten the ESF’s intended purpose—covering unforeseen revenue shortfalls. And revenue shortfalls should also be met with government spending relief.

ESF appropriations that wouldn’t go towards Harvey recovery goes mostly towards pension obligations to cover for mismanaged funds in the flawed defined-benefit plan of the Teacher Retirement System (TRS).

The TRS money is tied to HB 9and SB 12. Both bills look to improve the financial solvency of TRS, while paying out a discretionary additional 13th payment to retired teachers as a form of a cost of living adjustment (COLA).

A far better approach would be to enact the structural reform—including converting to a defined-contribution plan—that the TRS is desperately in need of in order for teachers’ retirement to be secured.

While Harvey was an unforeseen natural disaster that contributed to less taxes collected, which constitutes use of the ESF, the pension plan shortfalls were easily foreseeable considering TRS itself has discussed its funding shortfall.

Luckily, most uses of the ESF count towards the constitutional spending limit, which means at the very least there is a ceiling (albeit a very high one). So, even if the Legislature wants to use the ESF as its slush fund, there’s some limitation.

But there’s currently legislation in both chambers that would divert ESF funds to a new savings account in an attempt to earn higher returns—and possibly exclude spending of those returns from the limit.

HJR 10 and its enabling legislation HB 20 aim to lower the ESF’s sufficient fund balance in statute to 7 percent of general revenue-related funds, an action the Foundation supports. But a portion of the funds above that balance go into another fund called the “Texas Legacy Fund,” which would include severance taxes put into riskier assets with the hope of greater returns. Any use of returns from that fund could then be used for long-term funding issues, such as pension and bond debt.

But this doesn’t fall within the purpose of the ESF. It would mean taking on greater risk, and leaving less money in the more productive private sector.

SB 69, the Senate’s version of this effort designates the sufficient fund balance at 7 percent of general revenue-related funds and excludes the Texas Legacy Fund but includes an endowment fund with the goal of putting severance taxes in riskier assets to achieve higher returns. While this is better than putting in statute that returns from these assets must be spent, this is ultimately another poor mechanism because of putting taxpayer dollars at a higher risk and not putting excess money towards tax relief instead of growing government.

In planning for downturns or unexpected events, the ESF may ensure Texas remains economically and fiscally strong. But wanting to spend it on more than a rainy day isn’t the purpose of the fund, and instead of growing government, lawmakers should rein in spending, and grant the tax relief that will allow more Texans to prosper.