On Wednesday, the Legislative Budget Board (LBB) met to adopt a spending limit to govern how fast the next two-year budget will grow. The biennial ritual is performed in service of observing the state’s two primary spending limits, one constitutional and the other statutory. More specifically, those limits are: “the Article VIII constitutional tax spending limit on appropriations from tax revenue not dedicated by the Constitution and the consolidated general revenue spending limited, created by Senate Bill 1336, 87th Regular Session, for the 2024-25 biennium.” (The state is actually governed by four constitutional spending limits and one statutory limit).

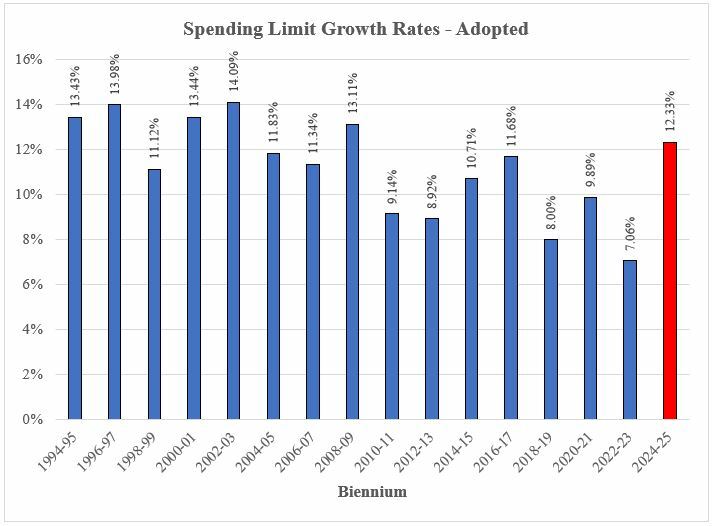

Ultimately, policymakers settled on a spending limit set at 12.33% for the biennium. So how does that compare with past limits? Answer: A little higher than average.

Here’s some more detail from the LBB:

Of course, the LBB’s spending limit is a ceiling, not a floor. There’s nothing preventing policymakers from spending much, much less than what the limit provides. And if they do so, they’ll be in a good position to deliver massive tax relief.

As readers well know, the next Texas Legislature is expected to have a general revenue surplus of nearly $27 billion. Many are hoping that a majority of that giant surplus will be returned to taxpayers in the form of “the largest property tax cut in Texas history.” This is possible but only if lawmakers make it a priority.

Given skyrocketing inflation and the cost-of-living crisis gripping many families, Texans will be looking to the Legislature to do big things next session to help. They can do so by spending less than the 12.33% limit allows and returning the bulk of surplus monies back to taxpayers.