The 86th Texas Legislature is already halfway over. The House’s budget will be on the floor on Wednesday. This is perfect time to review each chamber’s budget priorities. Unfortunately, it looks like this budget could exceed your ability to pay.

The good news is that there’s time to avoid that failure.

Let’s begin by reviewing the top fiscal priority of the 18 organizations in the Conservative Texas Budget Coalition—passing what could be a historic third straight Conservative Texas Budget that doesn’t increase by more than population growth plus inflation.

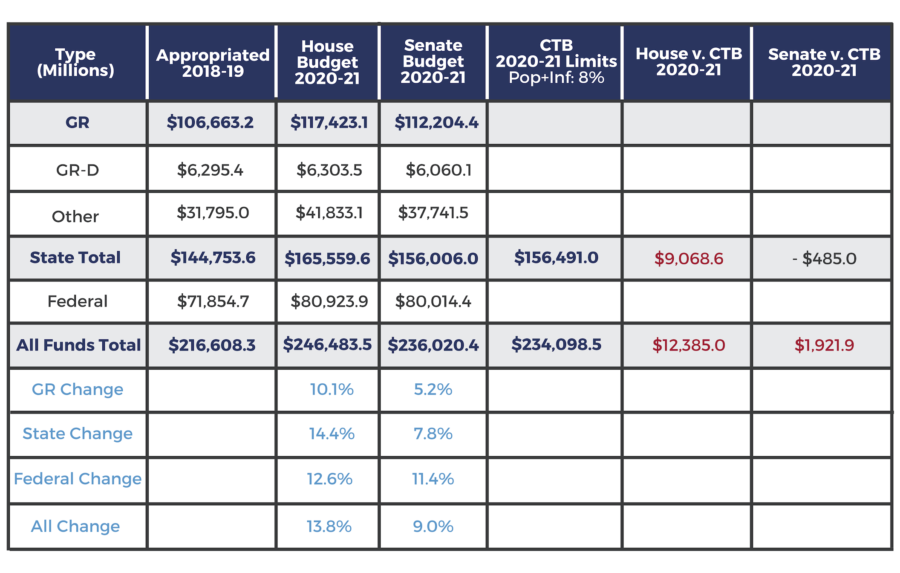

Table 1 presents the House and Senate budget amounts allocated for the 2020-21 period in their respective supplemental bill and general appropriations bill along with the Conservative Texas Budget limits. Each chamber’s budget figures exclude Harvey recovery costs, which the House’s budget includes roughly $8 billion and the Senate’s has about $7 billion.

Table 1: Texas Budget Recommendations Compared with the Conservative Texas Budget

We compare appropriated-to-appropriated for an apples-to-apples comparison, instead of the estimated/budgeted-to-appropriated as in the Legislative Budget Board’s budget documents. The only data available at this time is what’s appropriated, so these amounts provide taxpayers with the most consistent, accurate look at how their money is being allocated.

The House’s 2020-21 budget (general appropriations bill and supplemental bill) amounts of state funds and all funds exceed the CTB limits. State funds increase by $21 billion, or 14.4 percent, which includes more than $5 billion in money from the Economic Stabilization Fund (ESF). All funds increase by $30 billion, or 13.8 percent.

Remember, the all funds increase excludes about $8 billion towards Harvey recovery.

Clearly, this is a massive bill that far exceeds the average taxpayer’s ability to pay (as best measured by population growth plus inflation of 8 percent in the Conservative Texas Budget). A big part of this extra spending is in the $9 billion increase to public education and property tax relief. More than two-thirds of this goes to public schools, with the rest going to compress school district tax rates by 4 cents, which will likely mean a temporary reduction in your tax bill.

The Senate’s 2020-21 budget (general appropriations bill and supplemental bill) amount of state funds is below the CTB limit while that of all funds is above the limit. State funds increase by $11 billion, or 7.8 percent, which includes $211 million from the ESF for the Texas Tomorrow Fund. All funds increase by $19 billion, or 9 percent, which doesn’t include around $7 billion towards Harvey recovery.

These increases are much closer to the average taxpayer’s ability to pay and should be maintained to not put a greater burden of government on us. The increase is driven by more than $6 billion to public education and property tax relief. As with the House’s budget, the Senate allocates two-thirds of this $6 billion to public schools with the rest to property tax relief efforts, including raising the homestead exemption by $10,000 to $35,000—likely another temporary tax cut.

Currently, the Senate’s budget is in better shape, compared with the CTB limit in state funds but both chamber’s budgets exceed the limit for all funds—the total footprint of government. Given that the House’s budget will be on the floor on Wednesday, there’s a need for amendments to be filed to reduce every area of government so that the $9.1 billion overage in state funds and the $12.4 billion overage in all funds is eliminated.

This will take drastic action, but we must keep in mind that this is not “cutting” the budget. It’s just slowing the excessive growth that’s in the proposals now. The CTB is already lenient, in that it allows an increase of $11.7 billion in state funds and $17.5 billion in all funds. If these excesses aren’t weeded out, there will not be a Conservative Texas Budget, meaning Texans will pay more in taxes and Texas will be less prosperous.

The increases that are cut should be allocated to providing property tax relief to put school districts’ maintenance and operations (M&O) property taxes on a path to elimination.

For example, there would need to be a 5 percent cut in the growth across the budget to bring it in line with the CTB.

Or if you kept public education at $70 billion, which increases by $15 billion, or 27 percent, over 2018-19 appropriations, there would need to be a 7 percent cut in increases across the budget. These cuts to the increases could come in a number of ways, such as not funding an extra $2.1 billion for state facilities, reducing the extra amount to public schools, not funding $658 million for a discretionary 13th payment to retirees in the Teacher Retirement System of Texas without structural reform that’s in the supplemental bill, and a host of other areas.

By instead putting these taxpayer dollars towards property tax relief, we could make a substantial cut to school districts’ M&O property taxes. In fact, this could be done with just general revenue, as is done in several of the pre-filed amendments to be discussed during the budget debate.

But there’s even a chance that the 2018-19 budget (passed in 2017) may not remain a Conservative Texas Budget when the supplemental bills are considered.

The House’s supplemental bill to cover amounts due for the 2018-19 period is significantly under the CTB limit in state funds at $2.1 billion and slightly under the limit in all funds at $4.39 billion. We exclude the $1.2 billion towards Harvey recovery for 2018-19. The amounts for the 2018-19 period should set an example of how to stay under the CTB limits.

However, the Senate’s supplemental bill amounts for 2018-19 is $2.8 billion in state funds and $5.1 billion in all funds. This is well above the CTB limit. This makes it questionable whether the 2018-19 budget can remain the second straight CTB. These supplemental amounts include a large amount from the ESF and exclude $3.1 billion towards Harvey recovery.

By limiting the growth in government spending, legislators can follow the Foundation’s property tax proposal (see HB 2537 and HB 3733) to permanently cut school districts’ M&O property taxes this session by a large amount, and put those taxes on a path to elimination.

There are many opportunities this session for substantial reforms to public education, to ensure that more money goes to the classroom and permanent tax relief. But the key is to make sure spending is restrained to within the CTB framework. Otherwise, our prosperity today and tomorrow will be at risk.