The Issue

The Texas Constitution established public education through Article VII, Section 1, which states:

A general diffusion of knowledge being essential to the preservation of the liberties and rights of the people, it shall be the duty of the Legislature of the State to establish and make suitable provision for the support and maintenance of an efficient system of public free schools.

In the 2018-19 school year, Texas taxpayers spent a total of nearly $71 billion ($70,993,369,584) on public education according to the Texas Education Agency’s (TEA) 2018-19 Financial Actual Report. In the same school year, there were 5,416,161 students listed as enrolled members of Texas public schools. As a result, Texans spent approximately $13,000 per student. According to the TEA’s 2018-19 Texas Academic Performance Reports (TAPRs), the average elementary and secondary school class size was about 19 students. Therefore, Texans spent nearly $250,000 for the average class. At the same time, the 2018-19 TAPR shows that the average annual salary for teachers was $54,122.

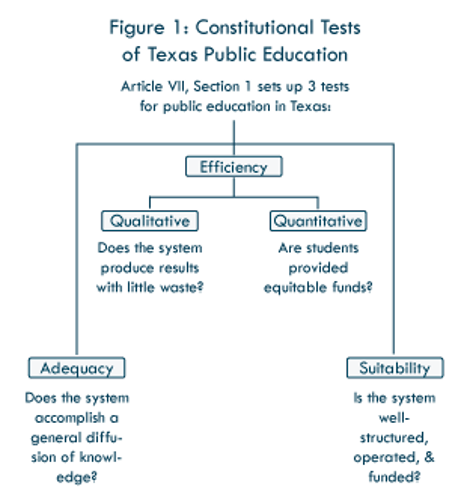

Since 1989, the Texas Supreme Court has ruled seven times on school finance. In the process, the Court has laid out four tests that the system must fulfill in order to be constitutional. These are illustrated in Figure 1. Texas School Finance: Basics and Reform explains these tests in greater detail, and Education and Property Taxes further discusses the history of the efficiency tests.

Critically, the Qualitative Efficiency test had not been addressed by the courts until the most recent ruling in 2016. In 2005, the Texas Supreme Court wrote that it wished to rule upon Qualitative Efficiency but did not do so because no petitioners at that time appealed to this test, which asks: does the system produce results with little waste? Like the courts, the Legislature must address this test, which requires an appropriate relationship between inputs and outputs.

Unfortunately, court decisions and legislative expediency have resulted in the ungainly system of wealth equalization referred to as “recapture” or “Robin Hood.” Were the source of education funding to be shifted from property taxes to some other revenue source, Robin Hood could be eliminated with no reduction to current district entitlements (see “Eliminating School M&O Property Taxes” for more details).

Public education is funded by an unnecessarily complex and inefficient system that is not student-centered. Texas’s funding formulas have been cobbled together based on political dynamics over time, not by what works for students.

The Texas Supreme Court concluded in West Orange Cove II that “Pouring more money into the system may forestall [constitutional] challenges, but only for a time.” Ultimately, Texas must create a solution to the fundamental problem of our system, which is that the system is not student-centered. This can be accomplished by reforming student allotments based upon the following principles:

- Shift the focus from equity for districts to equity for students.

- Assure that the student’s allotment is portable.

- Encourage districts to participate in student-based budgeting.

Structural efficiency would be improved if the allotment is made portable based upon parental discretion. This system encourages schools and districts to design systems that better respond to and serve their student population. Early adopters of educational choice, such as Grand Prairie ISD, have found that parent satisfaction increased, and about 9 in 10 of Grand Prairie ISD staff and teachers wanted to expand the choice system.

In such a system, educational consumers—parents and students—would have flexibility in the ways they allocate their education dollars within the public school system. By restructuring school finance in this manner, a real market for educational services will be created within individual schools, within school districts, and throughout the state, thereby resulting in significant improved efficiencies and effective resource allocation.

The Legislature passed a reform package (House Bill 3) during the 86th Legislature that made significant changes to the school finance system. This marked the first time in years that the Legislature took action on school finance without a requirement by the courts to do so. Notable changes included efficiency audits before elections to increase tax rates, increased teacher pay with allowances for incentive pay systems, changes to various student allotments, and a compression of property tax rates.

The Facts

- Total public education expenditures in the 2018-19 school year were nearly $71 billion. With 5,416,161 students, average per student spending was approximately $13,000.

- 1,101 public schools in the state of Texas were given a D or F rating by TEA for the 2018-19 school year. Well over half a million students attended those campuses—approximately 10% of all children enrolled in Texas public schools.

- Only 16% of high school graduates in 2017 achieved college-ready scores on the SAT or ACT.

- The 86th Legislature passed legislation that reduced recapture payments and the state’s reliance on property taxes for education funds.

- As part of House Bill 3, the Legislative Budget Board was tasked by the Legislature to study and report on options for reducing or replacing local property taxes as a revenue source for education. That study is due in the fall of 2020.

Recommendations

- Implement a student-centered funding structure for public education. Ensure that allotments are transparent, equitable, and portable.

- Deregulate public schools and allow educators to operate as professionals.

Resources

Education and Property Taxes: A Texas Sized Conundrum by Austin Griesinger, Emily Sass, and Parker Stathatos, Texas Public Policy Foundation (Feb. 2019)

Abolishing the “Robin Hood” School Property Tax by Kara Belew, Bill Peacock, Emily Sass, and Vance Ginn, Texas Public Policy Foundation (June 2018)

Texans Need More Education for Their Money by Vance Ginn and Stephanie Matthews, Texas Public Policy Foundation (Dec. 2017).

Texas School Finance: Basics and Reform by Michael Barba, Kent Grusendorf, Vance Ginn, and Talmadge Heflin, Texas Public Policy Foundation (March 2016).

School Choice and Climate Survey, Grand Prairie ISD (Dec. 2014).

Eric Hanushek’s Expert Report for School Finance Trial by Kent Grusendorf, Michael Barba, and Dianna Muldrow, Texas Public Policy Foundation (Oct. 2014).