The Issue

Some local retirement systems are governed by the Legislature, and it is putting taxpayers and retirees in harm’s way.

Over the years, more than a dozen municipal systems have convinced the Legislature to codify certain parts of their pension plans in state law. This includes provisions like “contribution rates, benefit levels and the composition of their board of trustees set in statute.” By doing so, these systems have made it difficult to make good government changes locally.

Absent legislative action, many critical features of these state-governed systems cannot be changed or modified by community stakeholders. Instead, a new law must be passed before reform can take root, which is no easy feat.

Since the Texas Legislature only convenes a regular session for 140 days every other year, community stakeholders only have a short time to achieve reform. This narrow window can be an especially challenging hurdle to overcome for stakeholders who are new to the legislative process or lack the right connections.

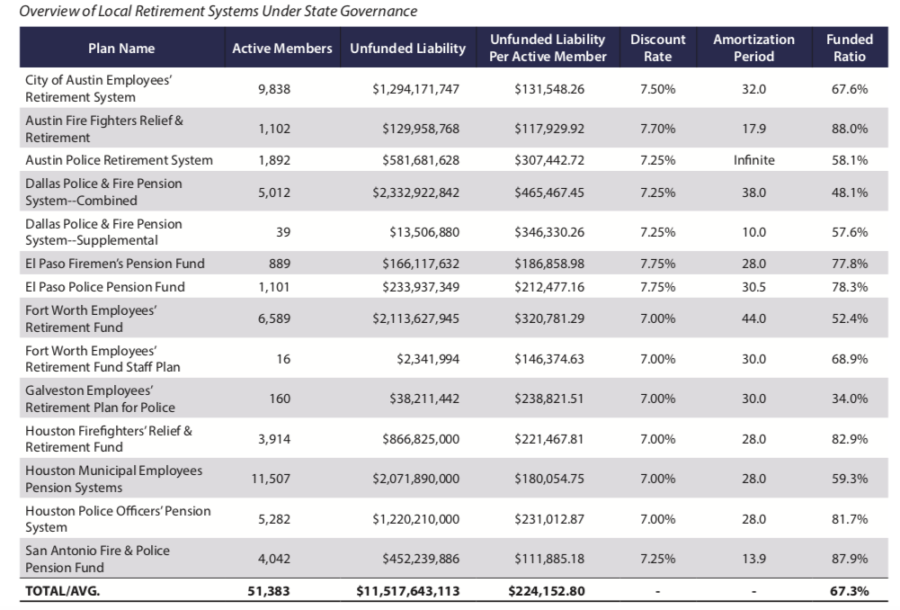

This particular arrangement has not been advantageous for those paying the taxes or those reliant on the systems. According to the Pension Review Board’s May 2020 Actuarial Valuations Report, the fiscal position of almost every state-governed plan is poor.

Source: Bond Review Board

Combined, the unfunded liabilities for Texas’s 14 state-governed systems—which are home to more than 50,000 active members—totaled $11.5 billion. The average amount of pension debt owed per active member is $224,152.

Among the systems, 5 of the 14 plans had unfunded liabilities standing in excess of $1 billion. Eleven of the 14 plans had unfunded liabilities totaling at least $100 million. Of all the systems, the Dallas Police & Fire Pension System—Combined had the single largest unfunded liability, at $2.3 billion, followed by the Fort Worth Employees Retirement Fund at $2.1 billion.

What’s more, 10 of the 14 systems had funded ratios below 80%, which can be taken as a sign of duress. Importantly, none of these plans had funded ratios of 100%, which would indicate that they are fully prepared to meet their obligations.

Finally, 11 of the 14 systems had amortization periods in excess of the Pension Review Board’s recommendation of 25 years. Even the Pension Review Board’s “maximum” recommended guideline of 40 years was exceeded by 2 systems: the Austin Police Retirement System (infinite) and the Fort Worth Employees’ Retirement Fund (44 years).

The actuarial evidence makes clear that the hardening of these plans in state law has been to their detriment. The Texas Legislature should remove these state-governed systems from the code and restore local control of local retirement systems. More specifically, policymakers should restore management and authority over these systems back to the community of their origin, so that stakeholders can implement necessary changes and ensure these systems’ long-term viability and recovery.

The Facts

- More than one dozen local retirement systems in Texas have engrained certain aspects of their plans in state law, including benefit levels, contribution rates, and the composition of their boards of trustees.

- In the absence of local control, the soundness and sustainability of these pension plans have come into question.

- Unfunded liabilities among these 14 state-governed plans totaled $11.5 billion or more than $224,000 owed per active member as of May 2020.

Recommendation

The Legislature should restore local control of local retirement systems under state governance to allow for greater community oversight.

Resources

Restoring Local Control of State-Governed Pension Plans by James Quintero, Texas Public Policy Foundation, (March 2017).

“A Solution to our Public Pension Problem” by Vance Ginn and James Quintero, Forbes (May 2, 2016).

SB 152. Introduced. 85th Texas Legislature. Regular (2017).

HB 1502. Introduced. 85th Texas Legislature. Regular (2017).