Mark Twain’s quip on the variable trustworthiness of statistics is part of America’s general zeitgeist at this point—but it remains no less true.

Which is to say, when people are throwing numbers and averages at you, it’s always a good idea to check the math—especially when those numbers are how much you’re going to be paying in taxes in the years to come.

I was browsing my sample ballot for the upcoming November election when I saw a “VATRE”—Voter Approval Tax Rate Election—from my local school district, Manor ISD. The ballot proposition announced in all caps an 8.2% increase in revenue.

That means an increase in taxes, right? Not so fast.

The Manor ISD website is quick to point out that this is a “tax rate DECREASE” that, if passed, “a homeowner of an average value home in Manor ($233,192) would see about a $10 DECREASE in Manor ISD property taxes per year.”

Wait, how does that work?

The government is getting more money from the people—an 8.2% increase in revenue—but the tax rate is going down and the typical homeowner should pay less?

This is, of course, where Mark Twain’s quip comes to mind. Let’s take a closer look at the numbers—and there, we’ll find a different story.

It is true that the total tax rate will theoretically go down—last year, it was $1.0861 per $100 of value, and this year, the planned rate is $1.0814 per $100 per $100 of value. This is a very small decrease—a fraction of a penny—but it is a decrease nonetheless.

This is where some disingenuous math comes in. Basically, the Manor ISD promise of “about $10” off of your taxes hinges on your house’s value not changing. If your home’s taxable value was $233,192 last year and stayed the same for this year, you would, in fact, see your tax bill go down—from $2,532.70 to $2,521.74. That is a decrease of “about $10.”

But home values don’t stay the same, and that’s where the rub is. In fact, the full version of Manor ISD’s VATRE admits this simple fact: Taxable home values are going up quite a bit, and so while the proposed tax rate is going down by $0.0047 per $100 of value, the “average” homeowner is paying quite a bit more.

If we look at the real numbers, the average taxable value of homes in Manor ISD last year was $215,431, which at last year’s tax rate would have been a tax bill of $2,339.80. But, values have gone up, and—as mentioned above—the average taxable value of homes in Manor ISD this year is $233,192, so even with the lower rate, the higher value means a higher bill of $2,521.74.

So yes, if your home did not change value at all—congratulations, the county appraiser appears to have forgotten about you, and you’ll get a nice $10 off your tax bill. With that kind of money in this economy, you can buy a nice coffee. Thanks, Manor ISD.

But, if you’re the average homeowner in Manor, your tax bill just went up by $181.94. Tighten your belts and find a way to cut down even more on groceries, because the taxman cometh.

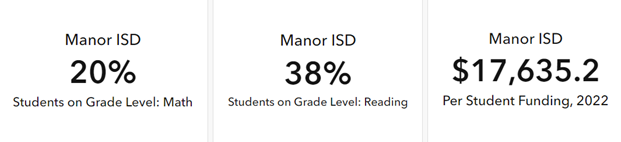

Oh, and on that note—how’s Manor ISD doing? Is that money being put to good use?

Oh.

Maybe the increased tax money is going to the classroom to help out the struggling students?

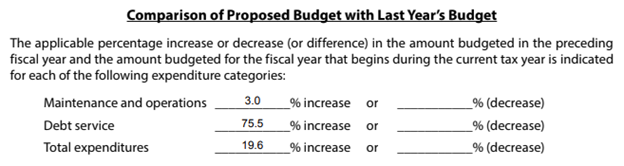

Oh. Never mind, it’s mostly going to pay down the $773.4 million in debt so that Manor ISD can take on more debt.

Awesome.