Texans are fed up with paying exorbitantly high property taxes. By following this buydown plan,* Texas can cut property taxes nearly in half within about 20 years by eliminating school maintenance and operations (M&O) property taxes, also known as the “Robin Hood” tax. This can be achieved by restraining state and local spending growth and using state surplus taxpayer dollars to buy down school M&O property taxes over time.

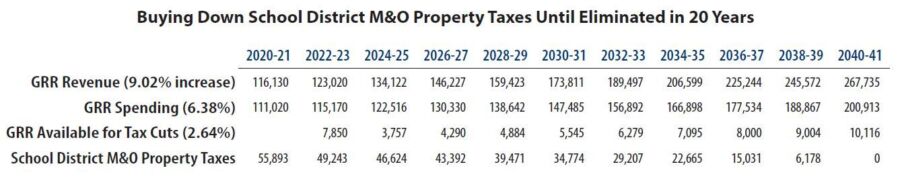

Under this buydown approach, every dollar not spent by the state will produce a property tax cut for Texans. Following the plan below would let the Texas Legislature keep their promise to taxpayers by lowering property tax bills—something missing in most other plans. If these assumptions hold over time, the buydown would eliminate the school district M&O property taxes during the 2040-41 biennium, which would bring the average property tax burden down to about 1.3% of a property’s value from today’s roughly 2.3%.

The Details

■ School district M&O property taxes are estimated to collect about $56 billion in 2020-21, making up nearly half of the hefty property tax burden Texans face.

■ Historical state general revenue-related (GRR) funds growth has averaged 9.02% biennially since 2012. Future state GRR spending increases will be limited biennially to the state’s new spending limit of population growth times inflation with an average of 6.38% since 2012. The resulting GRR surplus of 2.64% will be used to buy down school district M&O property taxes each biennium until they are eliminated.

■ The state will increase education funding to gradually replace the M&O portion of each local school district’s property taxes. School districts will set their tax rate each year to reduce property tax revenue by the amount of the state’s replacement funding and grow the revenue by, at most, 2.5% each period. Changes in city, county, and special purpose district property tax revenues should be limited to less than 3.5%, and preferably 0%, to further restrain spending growth. Any vote to exceed the new voter-approval tax rate must obtain supermajority consent.

The Results

■ If these GRR revenue and spending growth rates hold, Texas can eliminate school district M&O property taxes in 20 years. Growth variations will shorten or lengthen this buydown. Ensuring the fastest elimination will mean increased home ownership, a more efficient tax system in Texas as it moves toward sales taxes, and more economic growth supporting prosperity.