With a no shortage of candidates vying for attention ahead of the 2020 presidential election, health care reform remains a popular talking point. Universal coverage is back with a vengeance, but remains a complex issue that looks pretty on the surface and gets uglier the closer one looks.

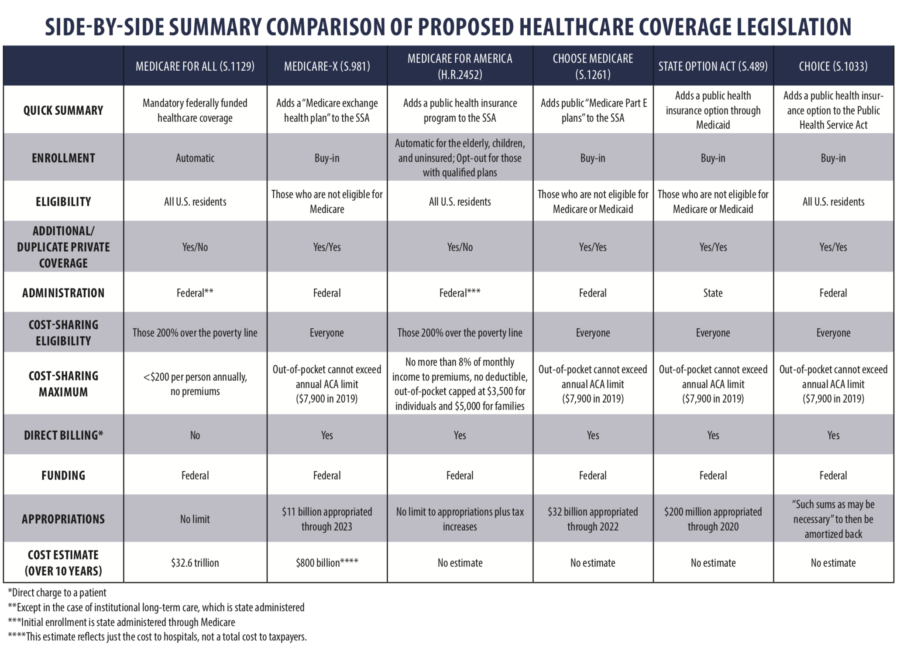

Plenty of universal healthcare plans are being proposed and discussed, but one that seems to rise to the top is Medicare-for-All. See the chart below for a comparison of popular plans in Congress right now.

Fully 56% of people polled said they were in favor of Medicare-for-All—but weren’t sure what that entailed. When asked if they were in favor of a Medicare-for-All system that eliminated private insurance, support dropped to 37%. But that’s exactly what it does. Even if you like your insurance, you don’t get to keep it.

Medicare-for-All ensures universal coverage through automatic, mandatory enrollment with no ability to opt-out. The leading estimate for the cost of this plan clocks in at over $32.6 trillion.

The James Madison Institute estimates that to cover that amount, Congress would have to increase personal and corporate income tax by 117% or increase payroll taxes 197%. Using Florida’s share of national income taxes as a model, the average Floridian would pay $8,405 more in taxes every year.

Medicare for America is considered a more “moderate” plan that would function similarly to Medicare-for-All but includes a pathway to opt-out—if your current plan is “quality,” (according to ACA standards). So you can have a private option, if you can afford it.

But like Medicare-for-All, someone under the Medicare for America plan cannot purchase private coverage that covers any of the same benefits offered by Medicare for America. Additional coverage can be purchased to supplement coverage in the case of both plans, but good luck finding a service worth covering that’s not already in the laundry list of benefits in these bills.

The other popular idea is to turn the federal government into an insurance provider. It would offer health insurance plans directly to consumers. Participation would be voluntary, and these plans would not eliminate private insurance. Plans like Medicare-X, CHOICE, Public Option, and Choose Medicare all function this way. Medicare-X alone is estimated to cost hospitals $800 billion.

The goal of these programs is to give everyone health care coverage by creating an artificially cheaper option. The idea is that if the federal government provides a cheaper option through tax-furnished subsidies and “negotiated” (fixed) drug prices, private insurance will be forced to lower its prices to compete. This does not solve the problem of high health care prices. Instead, it just subsidizes and stagnates prices on a larger scale than we’ve ever seen. And it’s no secret that price controls won’t lead to increases in quality of care.

At a minimum, these plans create an insurance company out of the federal government and further disrupt the health care coverage market through fake competition supported by taxpayer dollars. At their most extreme, health care coverage is nationalized, and the United States transitions into a single-payer system controlled by the Department of Health and Human Services.

Are you willing to sacrifice coverage that meets your needs for one-size-fits-all federally mandated health insurance? Universal coverage is a pretty picture until you dig into the details of what it means—in terms of options, cost, and quality of care.