This year, Dallas ISD appears poised to ask voters to approve a $3.7 billion bond, the “largest in Texas history.” The contents of the bond and the district’s falling student enrollment raise serious questions as to the need for such a large issuance at this time—as does taxpayers’ ability to afford more debt.

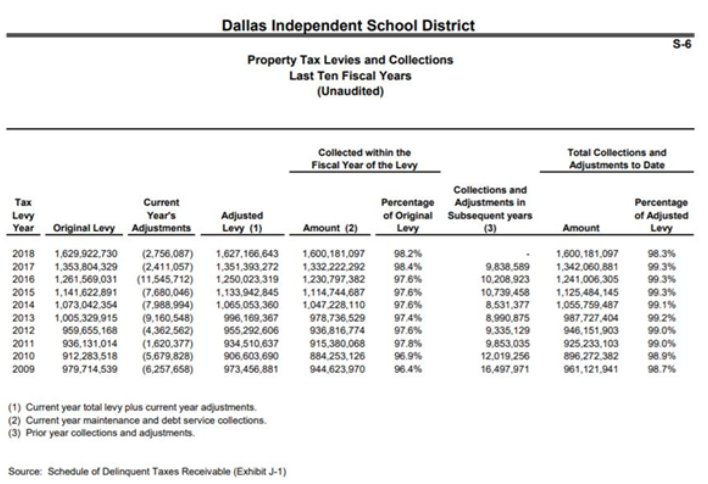

Dallas ISD has already put upon property owners in a big way. From 2009-2018, the district’s property tax levy increased by 69.3%, with revenues growing from $944.6 million in 2009 to more than $1.6 billion in 2018. For some low-income families and the elderly, the impact of skyrocketing tax bills has been devastating to their personal budgets.

This financial strain is likely to get worse too if the district successfully persuades voters to allow it to go further into debt. Despite the district’s claims that the bond’s approval will not “result in an increase in the tax rate,” borrowing more means its tax rate wouldn’t be allowed to come down either, which is what ought to be happening with appraisal values soaring. Debt isn’t free.

All of this raises an important question: Can Dallas ISD’s struggling taxpayers afford more debt?