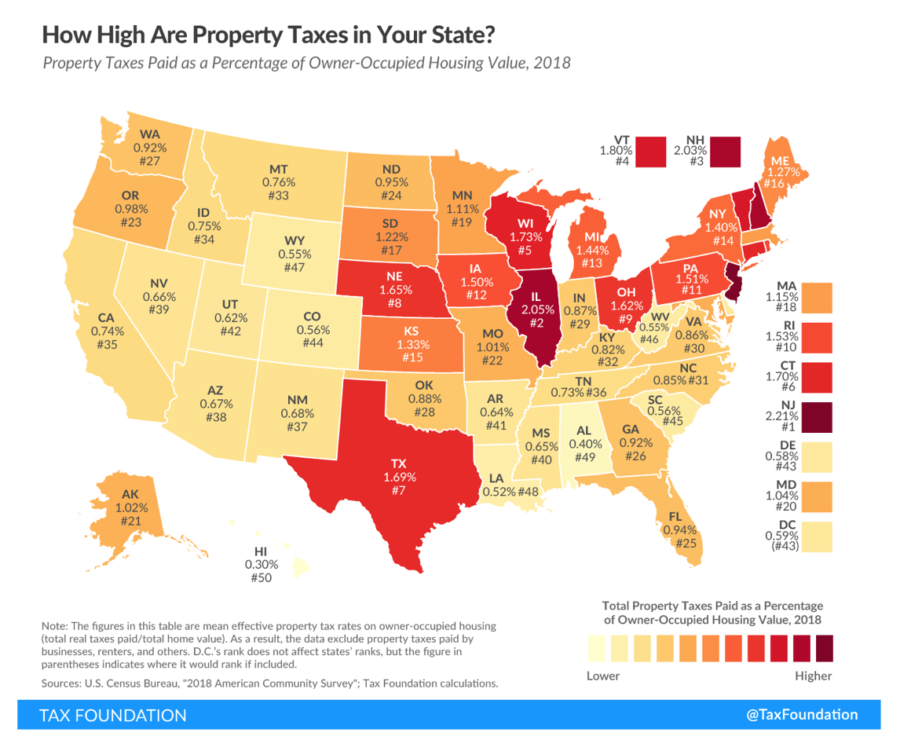

The Tax Foundation recently published a map of the country illustrating the property taxes paid in each state as a percentage of owner-occupied housing value in 2018. Of all 50 states, Texas had the seventh highest property tax burden in the country, with an effective rate of 1.69% of occupied housing value. This burden is something that Texans across the state know too well.

The article accompanying the map acknowledges that Texas to some extent relies on high property taxes in lieu of other tax categories – i.e., income taxes – though other states without an income tax do not necessarily have a high property tax burden (e.g., Florida). Regardless, in an economy hampered by COVID-19 and government lockdowns and with homeowners under substantial financial and mental stress, local governments have a responsibility to reduce the burden on taxpayers.

The Texas Public Policy Foundation has put forward proposals to reduce burdensome property taxes by focusing on Texas embracing final sales taxes over property taxes and governments implementing sound budget practices.

A final sales tax system is a more attractive alternative to a property tax. Property taxes are calculated on oftentimes subjective property values, which can rise without a change in homeowners’ ability to pay; Texans can adjust their spending habits to a sales tax, however. This results in a compounding effect of property taxes on holders of property every year that reduces their ability to pay them, forcing many to lose their property and to never truly own it.

One way to ease the property tax burden across Texas is to buy down school districts’ maintenance and operations (M&O) property taxes, which is about half of the property tax burden. This could be done by limiting state spending and using any surplus funds to cut the local property tax until it is eliminated, which could take roughly a decade, moving Texas towards sales taxes as they are the state’s top revenue source. However, this could be difficult to maintain session after session with the limitations on state and local government spending to achieve this in a timely manner, if at all.

Another way is for the state to immediately replace school M&O property taxes with higher sales taxes. An immediate swap would eliminate the risk that the switch to a final sales tax would be only temporary, a failure common to past property tax relief efforts. However, an immediate switch may be politically challenging to implement, so a way to mitigate this is to limit state spending and use surplus funds to cut the sales tax rate over time.

Switching M&O costs to sales taxes is not the only measure local (or state) governments should adopt. The other, and possibly even more fundamental to reducing barriers for opportunities to let people prosper, is implementing sound budgetary practices.

By reducing government spending through things like freezing new hires and pay raises and placing a moratorium on incurring any new taxpayer-funded debt, there are plenty of opportunities to cut taxes.

Local governments should volunteer for third-party audits to determine where areas of waste can be eliminated along with expensive lobbying contracts and longevity pay. Ultimately, practicing zero-based-budgeting, whereby local governments must justify every expenditure, could help achieve setting budget priorities that support effective government programs.

Any government approach to supporting an economic recovery in the wake of COVID-19 must begin with easing the burden on Texas taxpayers, and that approach must include reducing the burden of soaring property taxes and implementing sound budgeting at all levels of government.