Public trust in media is embarrassingly low. And after reading the latest editorial board opinion piece from the Dallas Morning News, it’s no surprise why.

On Tuesday, DMN’s editorial board published an editorial titled “Gov. Greg Abbott’s terrible property tax idea,” which tries to take aim at Gov. Abbott’s push to “put Texans on the pathway to eliminate property taxes.” But the editorial fails in some rather obvious ways. In fact, the piece is littered with errors and misrepresentations—so much so that it’s worth going through the most egregious one-by-one.

So let’s get into it.

Statement #1: “If you’re a suffering homeowner who has been carrying the weight for the cost of government in this state, you can thank Gov. Greg Abbott for doing all he can to keep that heavy burden on your back.”

This is simply inaccurate. The responsibility for runaway tax bills doesn’t belong to Governor Abbott, but rather local governments. That’s because, in Texas, “Local governments set tax rates and collect property taxes that they use to provide local services including schools, streets, roads, police, fire protection, and more. Your locally elected officials (school trustees, city council members, county commissioners) decide your property tax burden.” [emphasis mine]

So if you’re upset about skyrocketing property taxes (and who isn’t?), then blame your local elected officials. They are most responsible.

Statement #2: “…everyone needs government services, and property taxes are a stable and fair way to distribute costs.”

It’s easy to quibble with the generalization that everyone needs government services—after all, who “needs” a water park, a lazy river, a private plane, obscene contracts to clean city-owned port-a-potties, $70 million high school football stadiums, or any of the obvious waste, fraud, and abuse that is pervasive at the local level? But let’s set that aside for now.

The real error with DMN’s statement comes on the backend with its claim that property taxes are stable and fair. That’s not true, according to past TPPF research, which documents what most everyone already knows: “From 2016 to 2020, property taxes generally outstripped population and inflation in most of Texas’ populous cities, counties, and school districts.” Looking specifically Dallas-specific jurisdictions, the unreasonable growth of property tax levies is laid bare:

| 2016 – 2020 Percentage Increase | ||||

| Tax Levy Growth | Population | Inflation | Population & Inflation Combined | |

| City of Dallas | 56.5% | – 1.5% | 7.8% | 6.4% |

| Dallas County | 52.6% | 0.9% | 7.8% | 8.7% |

| Dallas ISD | 40.0% | -3.0% | 7.8% | 4.8% |

With those data in mind, do locally-administered property tax levies look either stable or fair?

Statement #3: “Abbott is promising to compress the school tax rate. That would spread the savings to commercial property owners, many of whom operate out of Texas.”

Even if tax relief provides some immediate benefit to out-of-state commercial property owners, have they not contributed to the Texas economy by hiring Texans? Made investments to expand their operations? Occupying brick-and-mortar facilities? Of course they have! And because they had a hand in spurring on the Texas Miracle, they should have every expectation of enjoying the fruits of their labor too.

Statement #4: “Abbott’s half-baked plan to eliminate the school maintenance and operations tax altogether is even worse. Taxes are going to come from somewhere to fund public schools. A massive increase in the sales tax, which would be the likely source, would be both grossly regressive and terribly unstable.”

This is where you can tell that DMN hasn’t done its homework.

In conservative policy circles, there are generally two big ideas being bandied about when it comes to achieving permanent property tax relief. Those include:

- A revenue neutral tax swap that would replace the property tax entirely with a reformed sales tax; and

- A tax rate compression plan that proposes to eliminate only the school district maintenance & operations (M&O) tax rate.

So what’s the difference?

For starters, the first involves a complete rework of the tax system whereas the second represents only incremental change. More importantly—and contrary to the DMN’s point—the second approach does not require any change to the sales tax rate or base. That is because it buys down the school M&O tax rate using surplus state tax dollars, i.e. “extra” money that government has over-collected.

Where do these surplus monies come from? Mostly, from the state’s sales tax which has been outperforming historical trends by a considerable margin, mostly on account of robust economic growth and high inflation. And because the state’s consumption taxes continue to perform well, the legislature has an opportunity to redirect those dollars to tax relief purposes (which is far better than the alternative—growing government).

Statement #5: “No one is going to want to relocate a business to Texas if employees have to pay a double-digit tax rate on the things they buy.”

Again, this point is irrelevant to the conversation currently underway at the Texas Legislature. But if and when it ever gets broached in a serious way, then it’s important to know that policymakers have choices on where to set the tax rate and how to adjust the tax base in order to provide a revenue neutral solution.

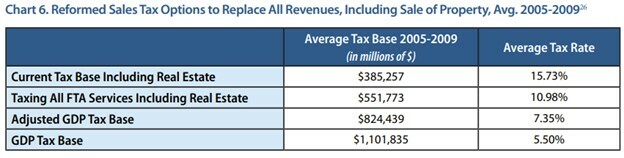

In October 2015—which was close to the last time that the Foundation wrote in earnest about this proposal—TPPF researchers provided policymakers with a list of options from which to choose. Those reformed sales tax choices included:

So even if policymakers wanted to consider a wholesale change to the property tax system, they are not bound to select from only a menu of double-digit options. That’s just fearmongering by the DMN editorial board—which clearly didn’t do its homework.