The Problem

Texans pay too much in property taxes because of excessive government spending. Current legislative efforts to address this will not bring substantial, long-lasting property tax reductions.

The Opportunity

The Texas Legislature could repurpose $5 billion of the taxpayer funds currently in HB 1 that would increase education spending and provide temporary tax relief and instead target those funds to provide meaningful, permanent property tax relief this session. This would also provide an opportunity to pass what could be the third straight Conservative Texas Budget.

Proposed Scenarios

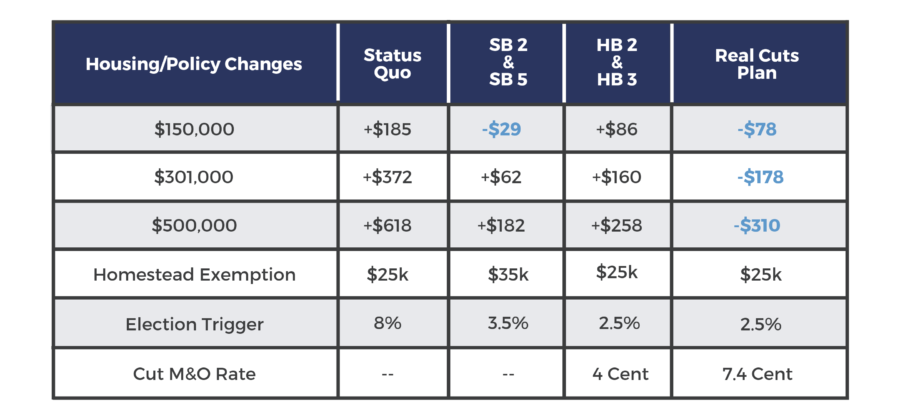

The chart below provides estimates of an Austin taxpayer’s 2020 property tax liability under various scenarios compared to 2019. The status quo scenario shows the increase in a homeowner’s tax liability in Austin assuming a 6 percent increase. The second scenario show the results of the latest Senate proposal of increasing the homestead exemption for school districts by $10,000 to $35,000 (SB 5) and reducing the rollback rates to 2.5 percent for school districts and to 3.5 percent for other local tax jurisdictions (SB 2). The third scenario examines the latest House proposal of cutting school districts’ property taxes by 4-cents (HB 3) and reducing the rollback rates to 2.5 percent for cities, counties, and some special purpose districts (HB 2). The final scenario uses the $5 billion currently in HB 1 to provide substantial, long-lasting property tax reductions as outlined in the Foundation’s plan: Abolishing the “Robin Hood” School Property Tax.

Scenarios of Property Tax Liability Changes from 2019 to 2020

The Result

The Senate and House plans only provide temporary tax relief. However, the Foundation plan would provide immediate and long-lasting property tax reductions that within about a decade would completely eliminate school districts’ maintenance and operations property taxes.