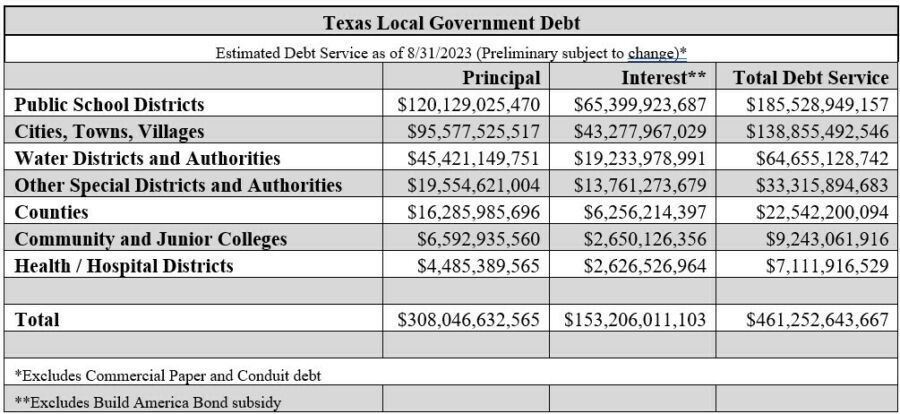

New data from the Bond Review Board suggests that Texas’ local debt soared to a total of $461.3 billion in fiscal year (FY) 2023, up from $417 billion in the prior year. That one-year jump represents a $44 billion increase or roughly 11% growth.

The most deeply indebted governmental entities were public school districts. In FY 2023, ISD debt grew to a staggering $185.5 billion, or more than 40% of everything borrowed. The vast majority of this debt is tax-supported, meaning it has property tax implications. The next biggest borrowers were cities ($138.9 billion or 30.1%) and water districts ($64.7 billion or 14%).

Given Texas’ population size, which was reported at 30,029,572 in July 2022, this level of debt translates into a per capita burden of almost $15,500. In other words, every man, woman, and child in the Lone Star State owes approximately $15,500 for his or her share of local overindulgences. Such deep indebtedness raises serious questions over affordability, sustainability, and fiscal prudence.

In order to prevent fiscal catastrophe, the next Texas Legislature should consider a suite of transparency and accountability reforms to bring commonsense change to this area of excess. As we detail in an October 2023 report, such changes might include:

- Requiring bond elections to be held exclusively in November so that the greatest number of voters have a say.

- Establishing minimum voter turnout requirements so that a tiny minority isn’t making outsized decisions.

- Reforming the use of certificates of obligation to prevent local governmental entities from abusing nonvoter approved debt instruments.

- Embracing greater government disclosure requirements so that voters know the cost of what they’re voting on.

These recommendations and others are all outlined in full in this new TPPF report on government debt in the 30 largest cities, counties, and school districts. Be sure to check it out so that you can get informed and get engaged!