New data from the Bond Review Board (BRB) shows an alarming increase in Texas local debt.

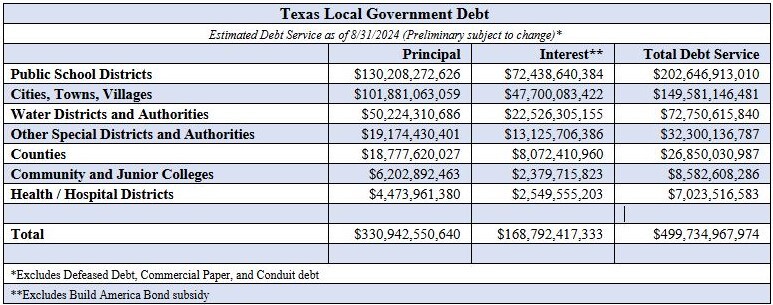

In fact, according to BRB’s latest estimates, which were secured using a Public Information Act request, the total amount owed by cities, counties, school districts, and special districts grew to a combined $499.7 billion in fiscal year (FY) 2024. That figure is nearly $40 billion higher than the prior year’s total.

Yet again, the most heavily indebted governmental type was public school districts. In FY 2024, ISD debt reached $202.6 billion, which represents about 41% of everything borrowed. This latest ISD figure is $17.1 billion higher than the previous year (i.e. $185.5 billion owed in FY 2023). On a per pupil basis, ISDs have accumulated approximately $36,600 of debt for every student currently enrolled.

The next biggest borrowers were cities ($149.6 billion or 29.9%) and water districts ($72.8 billion or 14.6%).

The growth trajectory of Texas local debt should be a top concern for policymakers as it threatens higher tax bills, softer economic growth, and long-term damage. In light of these concerns, it’s critical that the next Texas Legislature institute good government reforms that reinforce transparency, trust, and accountability. With these goals in mind, I’ve compiled a list of 15 I&S-specific solutions (see pgs. 10-11), which include some of the following recommendations:

- Require bond propositions to include 1-2 simple sentences above the ballot language that describes the measure’s general cost and purpose. The sentences should be written at an 8th grade reading level.

- Taxing units, other than school districts, should be required to include the following statement on bond propositions: “THIS IS A PROPERTY TAX INCREASE.” Accentuate the language so that it is obvious to all voters.

- Establish a minimum voter turnout requirement as a prerequisite for bond approval.

- Require bond elections to be held on the uniform election date in November.

- Prohibit ISDs from spending unspent bond proceeds on projects not approved by voters.

Together, the enactment of these reforms, along with the many others discussed in the report, promise a better path forward on public debt. It’s well past time to take aggressive action in this space and protect Texas taxpayers from insatiable local governments.