Some bad news for Texas taxpayers.

The Pension Review Board’s (PRB) latest assessment of Texas’ state and local retirement systems depicts a worsening financial condition that could mean higher taxes and fees for future Texans.

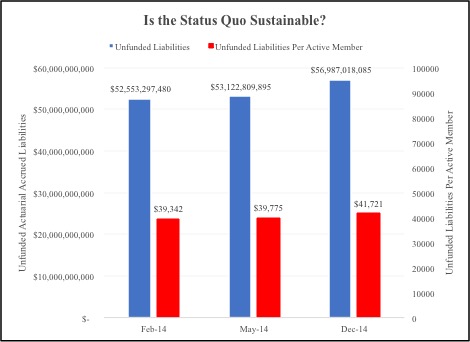

According to the PRB’s Actuarial Valuations Report for December 2014, unfunded liabilities—defined as “the share of all pension benefits earned by current and former employees that cannot be covered by current plan assets”—grew to an astonishing $56.99 billion, or more than $41,720 per active member. That marks a sizeable increase over the course of just one calendar year.

In February 2014, the PRB tallied unfunded liabilities for state and local retirement systems at $52.55 billion or $39,342 per active member. In May 2014, that figure grew to $53.12 billion or $39,775 per active member. And, of course, the latest data pegs the most recent total at near $57 billion owed.

Source: Texas Pension Review Board

At the root of Texas’ pension problems is the defined benefit system which, as the Foundation’s report Reforming Texas’ State & Local Pension Systems for the 21st Century explains, suffers from a critical fiscal flaw:

When a state or local government provides a defined benefit pension, the state is creating a government entitlement program. Entitlement programs violate the criteria of sound budgeting principles. Based on sound public finance principles, tax funded programs should be predictable and sustainable, and not reliant upon estimators, actuaries, market conditions, or the legislatures resolve to be fiscally prudent. Entitlement programs create expenditures that are difficult to predict and limit the government’s budget flexibility. Inevitably, entitlement programs lead to unsustainable government spending growth. Consequently, defined pension programs do not meet the criteria of sound fiscal policy.

State governments cannot solve the financial problems of entitlements—such as the Medicaid program—by simply acquiring more assets from which future obligations can be paid. In the case of Medicaid, fundamental reform of both the health care system and the state Medicaid programs are required to solve the Medicaid crisis. The same is true for state pension systems. As such, the defined benefit pension system is the wrong compensation policy for state and local governments.

Hence, the key to returning Texas’ public pension systems to sound fiscal footing is the elimination of defined benefit plans for new employees and beginning to transition the state’s workforce into a defined contribution model. To do otherwise is to risk the sustainability of the system as a whole.

To read more about the benefits of a defined contribution system, please see here.