The true cost of government debt is often understated.

Case-in-point: Houston ISD’s “record-breaking” $4.4 billion bond package.

To date, most of the media coverage surrounding HISD’s astronomical ask has focused on the principal amount alone, i.e., the $4.4 billion figure. However, as a recent Houston Chronicle article reminds, repaying government debt involves more than just paying down the principal. The reporter notes: “In total, if the bond passes, the principal costs of both measures would be about $4.4 billion, while the total estimated additional interest will be $4.5 billion.”

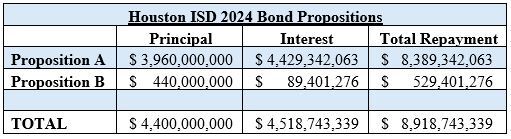

That’s right, if voters fully approve HISD’s bond package, then Houston taxpayers will owe more than $8.9 billion in total when principal and interest are accounted for, not the $4.4 billion amount many outlets continue to report. Here is more detail borrowed directly from HISD’s Voter Information Document (VID).

Source: Houston ISD Voter Information Documents

So just what is a VID? As explained in TPPF’s May 2024 Bond Election Report, “A VID is a debt disclosure document that must be prepared by a taxing unit with at least 250 registered voters.” It frequently accompanies the bond election order and its contents include certain debt detail, like ballot language, estimated tax impact, outstanding debt, and the anticipated principal and interest amounts.

Of course, some of these aspects can and have been gamed, but even still, VIDs provide important information that can help voters make more informed decisions about tax-and-spending proposals.

The intent behind VIDs is to give voters a tool to better understand the actual cost of government debt, not just the principal amount at stake. Because sometimes, as with HISD, a media-hyped estimate ($4.4 billion) can greatly understate what taxpayers will ultimately be expected to pay ($8.9 billion).

That’s the sort of information that every voter should know before casting a YEA or NAY for any measure.