On Wednesday night, September 6, 2023, ERCOT had its first emergency energy alert (EEA) since the winter storm in February 2021 and its first summer EEA since August 2019. While the mainstream media continues to misdirect the public toward the preferred talking points of wind and solar lobbyists, examining the real reasons behind why this happened points us right to what is really needed to fix the grid.

On several occasions during the past couple weeks, the wind did not pick up as the sun set, as it usually does during the summer. This happened again Wednesday night (09/06/2023) as wind generation was hovering around 5 GW, well below the 10+ GW expected during the 7-8 p.m. hour.

The sun did what it always does, which is to set at night, but the problem is that it sets almost an hour earlier in September than it does in July. Demand, while slightly below the record levels experienced in August, was just as high as it was in July, and it did not drop off fast enough to keep up with the drop in solar output during that critical evening hour.

Another reason the grid was tight the week of September 3rd-9th is because 6 GW of gas and coal power plants were offline, more than the usual 4 GW. However, more than 90% of gas and coal plants were still online for the duration of the week. If those power plants suddenly produced 50% less than expected, as wind did, the grid would collapse.

Some of these outages are occurring because of ERCOT’s “conservative operating posture,” which has kept extra resources online all summer, forcing many of them to forego needed maintenance, in a mostly futile attempt to ensure the variability of wind and solar output don’t cause sudden outages.

Like a car that has a lot of miles on it but hasn’t been maintained, more of these power plants are breaking now at the end of the summer when they are needed the most. ERCOT’s actions are not working and are costing consumers billions of dollars. The Public Utility Commission and ERCOT need to fix the market instead of trying to control it.

While the emergency was brief, it does point to several emerging problems with the ERCOT grid, most of which will be more prevalent in the winter than in the summer (because winter storms with low wind and sun last a lot longer than one or two hours around sunset).

ERCOT’s all-time demand record of 85 GW was set earlier this summer, but a more important record was broken twice in the past two weeks, including on Wednesday (09/06/23). ERCOT saw net peak load reach up to 70 GW, exceeding the previous record of 68 GW set in 2019. Net peak load is demand minus wind and solar output and is equal to the amount of dispatchable resources (gas, coal, etc.) needed on the system.

Think about this: Even though ERCOT has added 10 GW wind and 15 GW of solar over the past four years, the need for dispatchable resources is still growing. The need is growing much slower than total demand—but it’s still growing. Because wind and solar have such large gaps in output, they can barely reduce, much less eliminate, the need for dispatchable resources that can ramp up at any time. This is especially true in the winter, which is seeing faster demand growth than the summer and is subject to much larger gaps in wind and solar output.

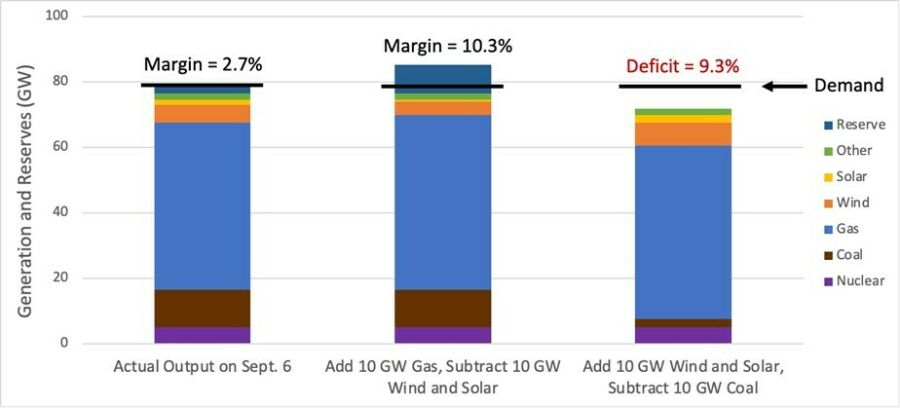

Imagine if 10 GW of wind and 10 GW of solar was replaced by 10 GW of gas power plants. Instead of reserves dropping below 3%, as they did Wednesday night when the emergency was triggered, they would have remained at around 10%, which is far from emergency conditions.

This points back to the investment imbalance problem at the heart of why Texas is in this bind. Federal subsidies for wind and solar are causing an investment overload in the ERCOT market resulting in more wind and solar than normal market conditions would dictate. This crowds out investment in everything else the market needs, including reliable power. Everyone is focused on the problem of underinvestment in reliability, but the real problem is excessive investment in resources that lack the attributes (high availability and dispatchability) needed to ensure reliability; wind and solar.

Nearly $100 billion dollars has been overextended in wind and solar infrastructure in Texas, plus tens of billions in federal and state subsidies. If the market had invested a mere $25 billion of that in reliability measures and dispatchable generation, we would not be in this situation.

One way to help achieve this rebalancing of the market and improve reliability is to require all generators, including wind and solar, to pay for the cost that their variability imposes on the system. This essential market reform will help control the rising costs of variability that are impacting Texas consumers and direct investment from more variable to less variable generation.

Two summers ago, Governor Abbott asked the PUC and ERCOT to initiate this critical market reform, but they have not done anything about it yet. Market reforms like this take years to implement and go into effect. The time to start doing this is now.