In 1988, Texas shared the sentiment of William Shatner who once declared: “If saving money is wrong, I don’t want to be right!”

It was that year that Texas created essentially a state savings account called the economic stabilization fund (ESF).

The idea then for a state savings account wasn’t a hard sell to voters. Economic downturns primarily from highly volatile oil and gas prices followed by a roller coaster of drastic spending cuts and tax raises left many Texans wanting fiscal stability.

The ESF is funded by severance taxes from oil and gas production above a certain threshold and has ballooned to about $12 billion. This amount is reaching closer to the constitutional limit of 10 percent of certain general revenue(GR), which is currently $16.9 billion.

According to the Texas Public Policy Foundation’s publication, the ESF, also known as the “rainy day fund,” was approved by voters with the language that it would be “used to offset unforeseen shortfalls in revenue.”

While the ESF has granted some fiscal stability even as Texas has diversified away from oil and gas activity, it’s in need of reform. In particular, it should be made more difficult to spend it on ongoing expenses and the cap amount should be reduced with excess funds going to tax relief.

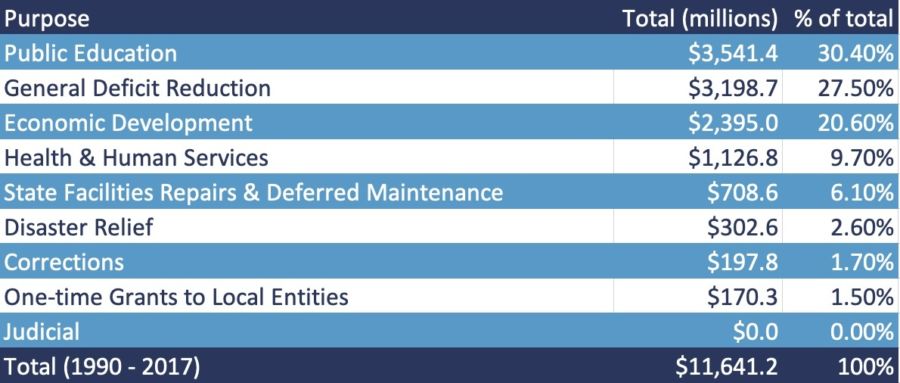

Legislators can tap the ESF at any time and for any purpose with a two-thirds vote of members present in each chamber. This isn’t much more than the three-fifths vote needed to cover the unforeseen revenue shortfalls. Given the amounts in Figure 1, only 30 percent of the $11.6 billion in ESF expenditures since 1990 have been for general deficit reduction and disaster relief—arguably the only two reasons originally approved by voters.

Figure 1: Appropriations from the Economic Stabilization Fund Since 1990

This state’s savings account, in many ways, is no different than a Texas family’s savings account—albeit much larger. If a family member continues to take money out of a bank account to pay for immediate, ongoing expenses, the individual isn’t likely to have sufficient savings over time. The same is true for ESF dollars.

However, legislators should be even more frugal than a family’s budget because the funds available to them aren’t theirs but rather a family’s dollars collected from taxes. Every ESF dollar could be used by a family to help achieve the hope of better educating a child or help fulfill a dream of starting a new business.

To ensure that the ESF dollars are budgeted wisely so families can achieve their hopes and dreams, three key changes should be made to it: 1) the two-thirds vote to tap the fund at any time and for any purpose should be increased to a four-fifths vote of each chamber, 2) the constitutional limit should be reduced from 10 percent of certain GR to 7 percent, and 3) excess severance taxes should be used for tax relief for maximum benefit.

The first recommendation is pretty straightforward as it would reduce the opportunity to tap these taxpayer dollars by for unnecessary reasons unless there’s a near consensus to do so.

The second recommendation prevents keeping too much money from sitting idly by. The current 10 percent of certain GR biennial cap is really a 20 percent annual cap. Research showsthat Texas could have a cap closer to 7 percent biennially, or 14 percent annually, to cover the state’s most severe fiscal downturns, which should primarily be solved with spending restraint.

The 7 percent biennial cap would amount to $11.8 billion now instead of $16.9 billion. It would also put it closer in line with what the joint committee that determines a sufficient ESF fund balancehas set in 2016 and this year of $7.5 billion or roughly 5 percent of certain GR.

The question then is what to do with severance taxes above this lowered cap.

Innovative ideas are being considered for how to use funds above a certain threshold. The Texas Comptroller has put forward an endowment idea called the “legacy fund,” which legislationwas pre-filed to potentially create this next session. Essentially, the idea is to put certain ESF money in riskier assets to get a higher rate of return and use the returns to fund long-term debt obligations, such as unfunded state pensions.

While this idea and others should be considered, just spend more taxpayer money on long-term debt obligations without reforming them, such as moving public pensions in crisisto defined-contribution plans for new employees, will mean these problems will keep resurfacing. Also, spending money raised through returns on riskier assets instead of tax collections removes taxpayers’ burden from government spending, which is counter to a principle of sound taxation.

Instead, severance taxes above the ESF cap should be used for tax relief in the form of lowering property taxesto support more economic activity and prosperity, which will help families achieve more of their hopes and dreams. This will have the added benefit of improving the solvency of the state’s unfunded debt obligations through reform and increased tax collections from more economic growth.

In the upcoming 2019 legislative session, legislators should consider a number of options that would heed Shatner’s declaration. Texas, too, wants to be right, and the best way to do that is to protect our fiscal stability by making needed reforms to the rainy day fund while letting families keep more of their money.

Image Courtesy: CheapFullCoverageAutoInsurance.com