Washington D.C. will soon flood the Lone Star State with “free” federal money and some North Texas cities are about to be absolutely inundated.

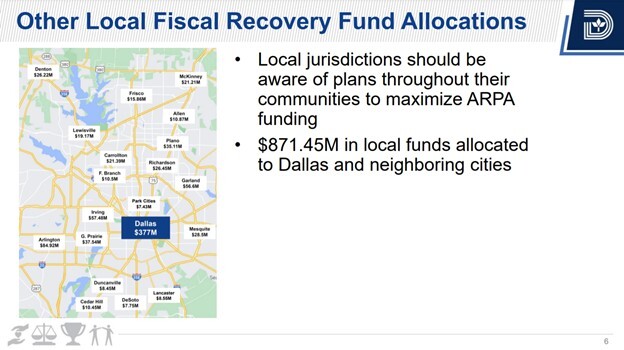

According to a recent presentation delivered at Dallas City Hall, Big D and neighboring cities are set to receive as much as $871 million over the next two years. The tsunami of COVID-19 cash will come directly from the U.S. Department of the Treasury and arrive in two tranches, the first in May 2021 and the second in May 2022. Cities will have until the end of 2024 to spend all the funds.

The wave of federal aid raises a slew of important questions, such as: Will these one-time monies be used to create new programs and an ongoing financial commitment? If so, do these cities plan to raise taxes to pay for these new programs once federal funding expires? What necessary budget reductions do these federal funds delay or derail? How, if at all, do these funds promote fiscal responsibility?

Considering how poorly some cities have managed their finances (e.g. property taxes and local debt in Texas’ most populous jurisdictions), it only makes sense to raise these questions now. The cost and consequences of aggressively expanding city services could be significant, especially once the money spigot is turned off.

The direct allocation of this money to local governments invites a host of unforeseen challenges, making it all the more important that the state ensure cities have their fiscal houses in order. One way that the Legislature can encourage cities along this path is encapsulated in Senate Bill 1437, which would require certain local governments to undergo a third-party efficiency audit before asking voters to increase property taxes above 3.5%. This type of audit requirement—which is already in place for school districts—promises to give policymakers and the public vital information before a big tax increase; promote responsible spending; and root out any waste, fraud, and abuse that may linger once those “free” federal dollars have dried up.

Enacting reforms like this now will help avoid a D’Oh! moment later.