On Wednesday, the Dallas city council will consider adopting a property tax rate of $0.7765 per $100 of value. While the proposed tax rate is effectively the same as the previous year’s rate, its adoption would force tax bills higher since property values are up. The city projects a 5.28% increase in certified values over the year.

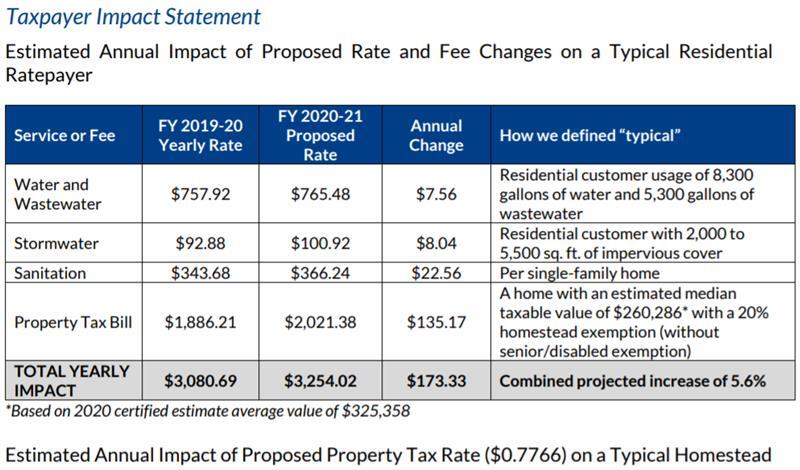

According to the city’s own data, keeping the tax rate level will cost most homeowners more. In fact, the average Dallas homeowner can expect to pay $135 more in taxes this year if the tax rate isn’t lowered. When fee increases are taken into account, the typical homestead can expect to pay $173 more for the cost of city government. The overall increase in taxes and fees is 5.6% higher than the previous year. The unemployment rate in the Dallas-Fort Worth-Arlington area is 7.5%.