In 2023, the Texas Legislature passed historic property tax relief that was intended to cut the average homeowner’s tax bill by roughly $1,300 per year. Unfortunately, tax-and-spend local governments have eroded much of those anticipated savings through rate hikes, bond elections, and a special type of tax increase election known as a Voter-Approval Tax Rate Election (VATRE).

The term VATRE refers to an election that is automatically triggered when “a taxing unit adopts a tax rate that exceeds the voter-approval tax rate.” The voter-approval tax rate (VATR) limits property tax revenue growth in cities, counties, and certain special districts to 3.5% annually, unless voters say otherwise. For school districts, the VATR “is equal to the district’s maximum compressed tax rate (MCR) determined by TEA plus the greater of $0.05 or the district’s Tier 2 pennies from the prior tax year (excluding disaster pennies) plus the district’s debt rate.” While the calculations are difficult to determine, it is important that voters understand a VATRE’s effect, as it is very often profound.

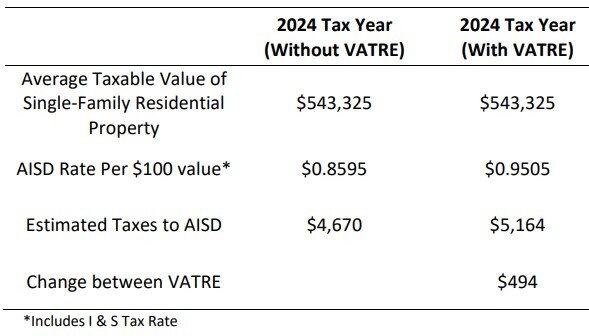

Consider Austin ISD, for example. In November 2024, the district will ask voters to approve a VATRE which, according to its latest efficiency audit report, will hike the average homeowner’s tax bill by almost $500 annually. If passed, this proposed tax increase will come in addition to a separate $300 tax hike approved by the board earlier this year (see General Tax Rate Election FAQs).

Source: Austin ISD 2024 Efficiency Audit Report

Of course, Austin ISD isn’t alone in pushing VATREs this election cycle. In fact, quite a few school districts are seeking to squeeze taxpayers in this way. We here at the Texas Public Policy Foundation have tracked more than 40 tax increase elections that will be decided this November and present a list of them below. In most cases, a responsive efficiency audit report is also given.

- Alief ISD (efficiency audit here);

- Alvarado ISD (efficiency audit here);

- Argyle ISD (efficiency audit here);

- Anthony ISD (efficiency audit here)

- Austin ISD (efficiency audit here);

- Beaumont ISD (efficiency audit here);

- Borger ISD (unable to locate efficiency audit);

- Brownsboro ISD (unable to locate efficiency audit);

- Bushland ISD (unable to locate efficiency audit);

- Canyon ISD (efficiency audit here);

- Celina ISD (efficiency audit here);

- Coppell ISD (efficiency audit here);

- Darrouzett ISD (unable to locate efficiency audit);

- East Central ISD (efficiency audit here);

- Fort Stockton ISD (efficiency audit here);

- Frenship ISD (efficiency audit here);

- Frisco ISD (efficiency audit here);

- Grapevine-Colleyville ISD (efficiency audit here);

- Hedley ISD (unable to locate efficiency audit);

- Industrial ISD (efficiency audit here);

- Junction ISD (unable to locate efficiency audit);

- Kirbyville CISD (efficiency audit here);

- Liberty Hill ISD (efficiency audit here);

- Magnolia ISD (efficiency audit here);

- Manor ISD (efficiency audit here);

- Marble Falls ISD (efficiency audit not completed);

- McLean ISD (efficiency audit here);

- Midlothian ISD (efficiency audit here);

- Montgomery ISD (efficiency audit here);

- Northwest ISD (efficiency audit here);

- Oakwood ISD (unable to locate efficiency audit);

- Rochelle ISD (efficiency audit here);

- Rockwall ISD (efficiency audit here);

- Round Top-Carmine ISD (unable to locate efficiency audit);

- San Angelo ISD (efficiency audit here);

- San Marcos CISD (unable to locate efficiency audit);

- Seguin ISD (efficiency audit here);

- Spring ISD (efficiency audit here);

- Texas City ISD (efficiency audit here);

- Vega ISD (efficiency audit here);

- Victoria ISD (efficiency audit here);

- Yoakum ISD (unable to locate efficiency audit); and

- City of Cibolo (efficiency audit not required of municipalities).

Is your city or school district on the list of governments eyeing a major tax increase this year? Is it justified on the basis of any information in the efficiency audit, or does the report suggest there’s still more to do to control costs? Let me know your thoughts and comments at: [email protected]