There are seven states with no tax on any personal income: Alaska, Florida, Nevada, South Dakota, Texas, Washington and Wyoming.

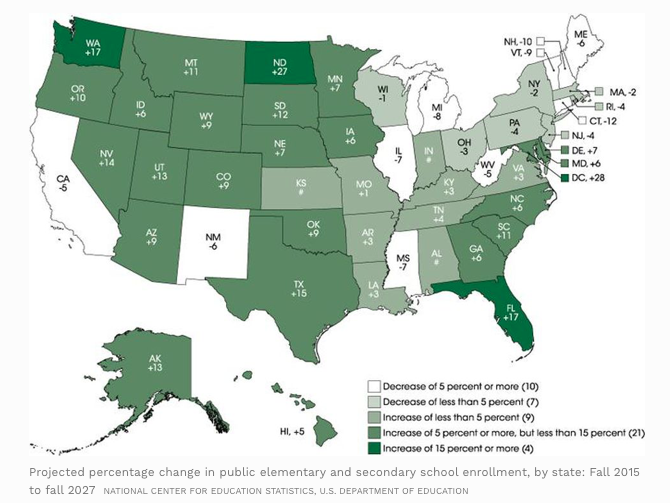

According to a recently updated National Center for Education Statistics projection, the eight states expected to see the highest growth in public and charter school enrollment in the 12 years from 2015 through 2027 are: North Dakota (27%); Florida (17%); Washington (17%); Texas (15%); Nevada (14%); Alaska (13%), Utah (13%) and South Dakota (12%). That means that six of the top eight states for public school growth don’t levy an income tax.

Wyoming, a state whose coal industry has been hard-hit, is expected to experience a strong 9% increase in public school enrollment, putting in a 12th-place tie with Arizona, Colorado and Oklahoma.

Of the two states in the top eight for public school growth that do charge an income tax, North Dakota and Utah, North Dakota is considered to have an average tax burden but, the 47th-most populous state has seen a surge in employment due to the advent of the shale oil industry there, while Utah is considered to be a low-tax state.

There are two interesting policy connections between no income taxes and strong public school enrollment growth.

First, states with no income tax make it less expensive to raise a family or start a business. Sure, correlation doesn’t equal causation, but, public policy choices don’t occur in a vacuum and have real effects on people’s decisions.

Second, the teacher’s unions in low-tax and high-tax states alike frequently call for tax hikes to fund more public school spending.

Yet each of the six states whose residents claimed the highest average state and local tax (SALT) deductions on their itemized 2014 federal tax returns is expected to see their public school enrollments drop. Those states are New York ($21,000); Connecticut ($18,900); New Jersey ($17,200); California ($17,100); Massachusetts ($14,800) and Illinois ($12,900). Connecticut, in fact, will see the nation’s most precipitous decline in public school students, at 12%.

Adding further evidence to the link between state tax policy and employment growth that undergirds public school enrollment, since the Trump tax cut and reforms were signed into law in December 2017, employment has surged in low-tax states relative to high-tax states. This may be due in part to the new limitation on SALT deductibility to $10,000 per filing household. In the 19 low-tax states, the private sector employment growth rate over the 11 months after the tax law passed through November 2018 is 71% higher than in the ten high-tax states. This translates to about 466,000 additional jobs in low-tax states in less than a year, with each job supporting more than one person.

The teachers’ strike in Los Angeles, the nation’s second-largest school district in the nation’s 4th-highest taxed state (with the highest marginal income tax rate, 13.3%) is set to enter its sixth day. The union is demanding more pay, more benefits, smaller class sizes and the curtailing of competition from privately-managed public charter schools. Yet the district is facing a projected 5% decline in public school enrollment. That doesn’t seem to bother the teachers, even as Californians vote by moving van and U-Haul, bolstering public school enrollment in low-tax states.