This commentary originally appeared in The Federalist on May 12, 2016.

If you want low energy costs, live in a red state.

In 2006, California Gov. Arnold Schwarzenegger and the Democratic legislative majority embarked on a program to double renewable electric generation to 20 percent while phasing out coal. At the time, American natural gas production had plateaued, and overseas imports were expected to fill the gap with up to eight liquefied natural gas (LNG) terminals proposed for the West Coast, bringing fuel in from as far away as Qatar.

California’s electricity rates were then 44 percent higher than the national average. But California has low per-capita consumption of electricity mainly because California has a temperate climate—for residents near the coast—while relying heavily on natural gas for residential heating.

By 2014 California’s rates were up, but, compared to the rest of the nation, stood at 45 percent above the U.S. average, a small relative increase since 2006. Meanwhile, it reached its renewable policy objectives, with electricity from costlier green energy rising from 10.9 percent to 20.1 percent. Impressed with their success, California lawmakers have hiked the renewable mandate from 33 percent by 2020 to 50 percent by 2030.

Lost in this apparent green energy triumph is one inconvenient truth: California couldn’t have doubled renewable electricity at relatively low cost to consumers without the advanced hydraulic fracturing techniques—fracking—that came into widespread use a decade ago.

The Price of Natural Gas Plunges 70 Percent

On the eve of California’s accelerated shift to renewable electricity, energy forecasts assumed increasing scarcity would drive up the price of natural gas. Green energy proponents in the legislature claimed the rising cost of natural gas would make renewable energy look like a bargain in comparison.

But the flood of new natural gas supply due to fracking caused the opposite to occur. The price of natural gas plunged some 70 percent while the cost to generate electricity from natural gas declined about 40 percent. So as California was doubling its share of electricity from costly renewables, its retail electricity prices rose in line with the rest of the nation as the cheaper natural-gas-generated electricity covered for the more expensive green energy.

Had natural gas prices gone up 20 percent, as projected in 2006, today’s electric rates in California would be some 26 percent higher—equating to a $150 per month increase in summer cooling costs for millions of Californians living far from the cool breezes of the Pacific.

California’s relatively pain-free green energy shift has given politicians there a false sense of security that they can do more at little cost to ratepayers and the economy. Unfortunately, as renewables march towards the 50 percent mandate, consumers may be hit with average retail electricity costs hikes approaching 70 percent. Additional capital costs for green energy production, storage, and distribution could add another $104 billion ($11,000 for a family of four), according to a 2014 study by Energy and Environmental Economics, Inc.

Of Course, the EPA Learned Nothing

California’s decarbonization push foreshadowed the Environmental Protection Agency’s Clean Power Plan, which, if it finally overcomes the courts, would make 47 states and three tribal governments conform to California’s energy vision—which is the point of the whole exercise. We can’t have some states show autonomy from liberal orthodoxy and gain a competitive advantage, now can we?

One added complication in the political drive for wind and solar is a little-known aspect of crony corporatism. In many states, electric utilities are publicly regulated and enjoy guaranteed rates of return on their investment. Higher costs for electricity mean higher profits. Thus, large electric companies often support the shift to costlier electricity.

This was seen in California in 2006 when Senate Bill 1368, a bill to ban the renewal of coal-fired power contracts, was passed and signed into law. Amid the lines of technical language mandating the use of non-existent coal power technology or no coal at all, the bill quietly allowed publicly regulated utilities to double their profits, so long as the power generated was politically approved green power. As a result, one of California’s largest utilities, Pacific Gas and Electric (PG&E), supported the anti-coal bill and today, PG&E’s customers pay more for the privilege.

As much as California has moved to greater and greater political intervention in energy markets, such as cap-and-trade, Texas has moved the other direction. By January 1, 2007, some 85 percent of the Texas electricity market had been deregulated. Critics predicted higher costs and shortages. In 2006, Texas’ electric rates were 16 percent above the national average. But by 2014, Texas consumers were paying 14 percent less for their electricity, on average, than the rest of the nation. Market deregulation was a success.

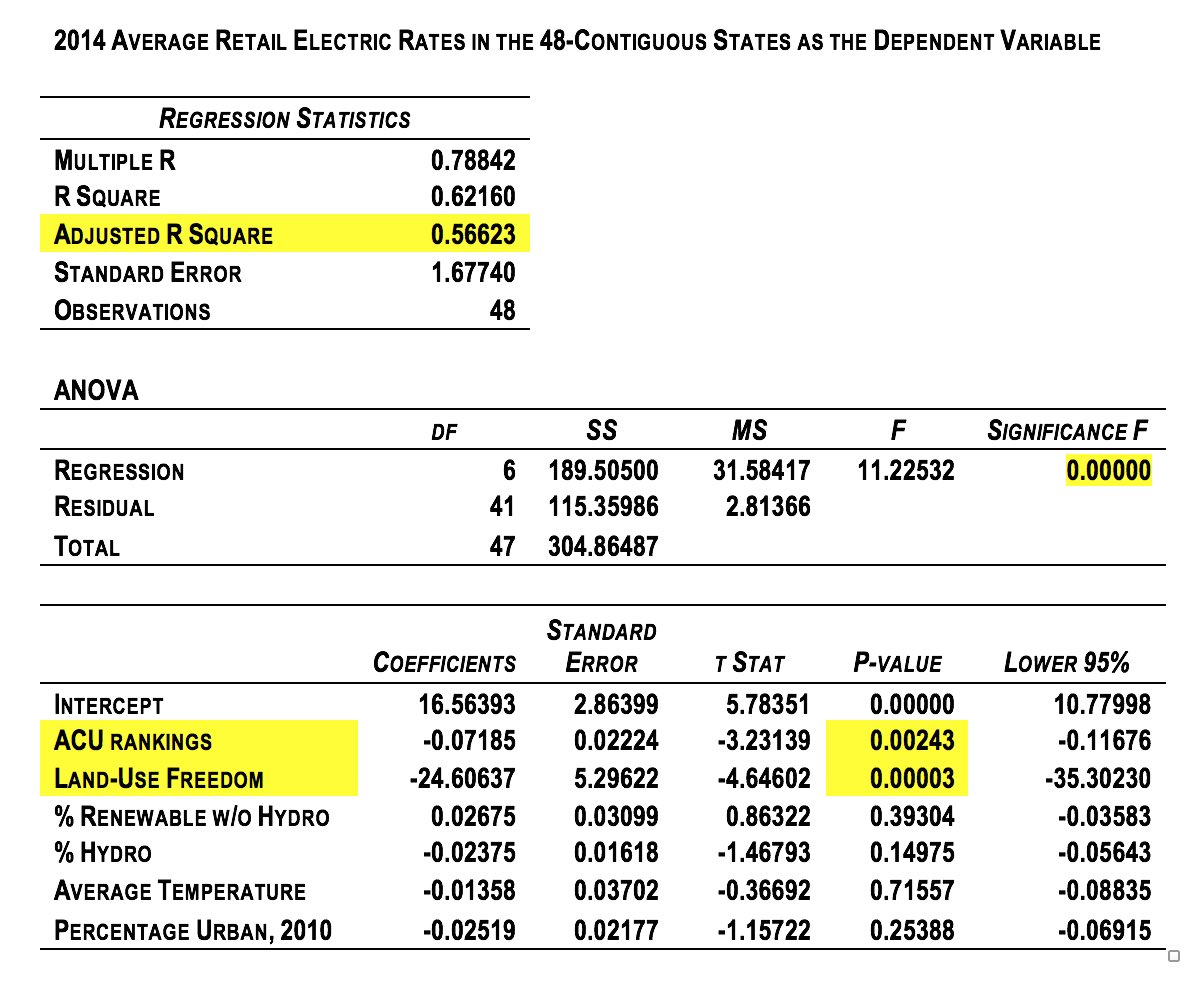

The cost of generating electricity varies widely by method as does the average retail price of electricity in the states. Looking at electrical rates in the 48 contiguous states, one might expect to see prices vary according to the amount of inexpensive hydropower or more expensive renewable power or other factors such as the temperature or level of urbanization.

Instead, a multivariate regression shows that, among six variables, two do a good job of predicting electric rates in a state: the Mercatus Institute’s land-use freedom index and the American Conservative Union’s state legislature rankings. The more conservative states have less expensive electricity. In other words, freedom matters more than fuel in determining electricity rates.

Chuck DeVore is vice president of national initiatives at the Texas Public Policy Foundation and served in the California State Assembly from 2004 to 2010.