Former President Barack Obama once proclaimed that: “The last thing you want to do is raise taxes in the middle of the recession because that would just suck up and take more demand out of the economy and put businesses in a further hole.” Like a broken clock, he got that one right.

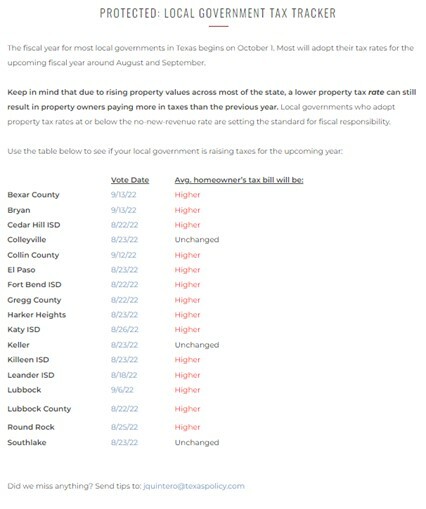

Raising taxes in a recession is the last thing that any government should do. That’s why the Texas Public Policy Foundation has just launched a new Local Government Property Tax Tracker, which aims to track and identify local governments in Texas that are hiking taxes on homeowners. Something like this is very much needed given all the misinformation around tax rates, valuations, and who bear responsibility for the government largesse.

Here’s a preview:

Over time, this list will grow (side note: there are almost 5,000 local governments, so we won’t be able to get them all on our own so feel free to send us any that should be added to the list); but the real goal of this effort to call attention to the need for serious property tax reform that doesn’t allow the current misinformation environment to carry on. Because the truth is, while local officials are playing shell games with rates and values, real people are being hurt.

Stories of Texans getting crushed by taxes are everywhere. “I don’t have money to pay so much, my property tax has almost tripled,” said Reymundo Garcia from El Paso. “If someone doesn’t have enough money to pay, they’re going to lose their property.”

Garcia is only one of many Texans worried about losing their properties. Lola Rodriguez inherited a house that has been in her family for 70 years. Her late grandfather paid off the house for $70,000, but Rodriguez, who works two jobs and is raising two children, is struggling to keep up with the soaring taxes. The home was recently appraised at more than $202,000 — nearly $70,000 more than four years ago, and just keeps rising. “People tell me to sell high and go somewhere else. But why should I have to leave?” she said. “There’s no way I could afford purchasing my house if I wasn’t already in it. The question is how much longer do we hold out?”

Another resident, Lisa Woods, is close to losing the home her uncle built almost 100 years ago. Her tax bill has jumped to from $900 to $1,300. Woods promised her mother she would keep the house in the family. But she is having a hard time keeping up with her spiraling tax bills. “I do a lot of crying. This house means everything to me. There’s nothing like pulling into this driveway, and knowing I own this home,” she said.

Since the unprecedented increase in home prices has made it harder for people to buy or keep a home, an increasing number of Texans have been looking to rent instead. However, rent has also skyrocketed, with property owners forced to pass down the historically high costs of maintaining a property. Rebecca Brown, a resident of Carrollton, was left scrambling last year after being told her rent was increasing by nearly $350 a month. “It stressed me out immediately because, I mean, that’s a huge jump,” Brown said. “That’s about $400. To try to come up with an extra $400 a month, that’s not that easy to do.”

These are just a few of the many stories that make it critical to track the truth about property taxes and push hard for big changes next session.