The Issue

Texas’s state budget has grown considerably faster than Texans’ ability to pay for it since the 2004-05 budget period. As a result, the Texas Public Policy Foundation created the Conservative Texas Budget (CTB) in 2015 to set a maximum threshold for growth in the budget based on changes in population plus inflation. This threshold essentially freezes per capita initial appropriations of all funds to get the budget back on track and away from its excessive trend over time, giving Texans more money in their pocket and more opportunities to prosper. Figure 1 presents the Conservative Texas Budget for the 2022-23 period.

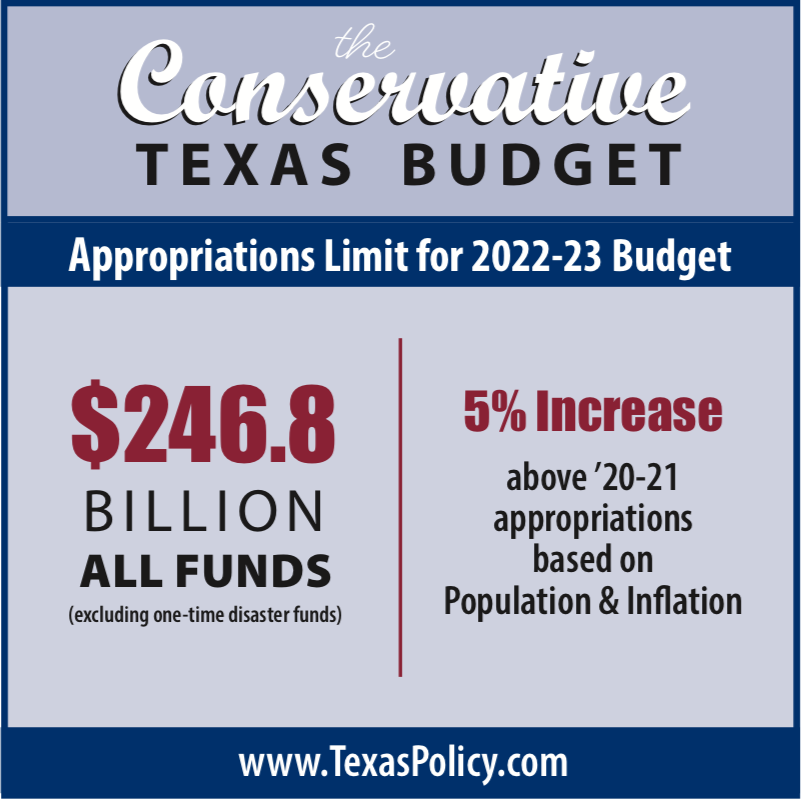

Figure 1. The 2022-23 Conservative Texas Budget

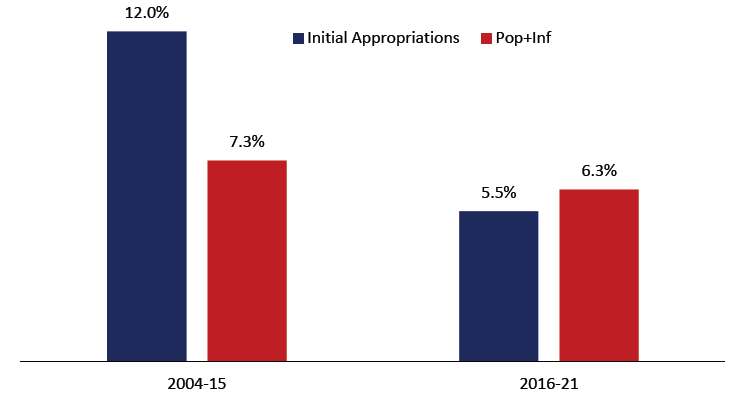

Since its inception, the CTB has helped limit the growth of appropriations over time as noted in Figure 2. Prior to the CTB, the average growth rate of the biennial budget from 2004-2015 was 12%. With the CTB in place, the average growth rate was just 5.5%. More importantly, prior to the CTB, the average growth rate of appropriations exceeded that of population plus inflation by almost 5 percentage points, whereas, since the CTB, appropriations grew by an average of almost a full percentage point below population and inflation.

Figure 2. Texas’s Biennial Budget Growth Has Slowed Since Creation of the CTB in 2015

Source: Legislative Budget Board’s Fiscal Size-Ups and authors’ calculations of average biennial growth.

If the Texas Legislature passes a General Appropriations Act that grows by less than the sum of population growth and inflation, then it is a Conservative Texas Budget. Given the excessive growth in the state budget over time and the potential tax receipts shortfall resulting from the COVID-19 situation, the 2021 legislative session should cut the budget by eliminating wasteful spending. Families are responsible with their budget, so their tax dollars should also be budgeted responsibly by government.

Looking back, legislators in 2003 and 2011 passed a budget that increased by less than population growth plus inflation. While the CTB was not around then, these budgets would have met its criteria. However, subsequent legislatures in 2005 and 2013 increased the budget substantially more than this metric, thereby erasing prior benefits to taxpayers. The 2015 and 2017 legislatures also kept initial appropriations growth below the corresponding CTB. Unfortunately, the Legislature’s 2019 budget slightly exceeded the CTB threshold, even after we excluded appropriations for Hurricane Harvey recovery efforts and property tax relief.

Since the 2004-05 budget, the state budget has grown by an estimated 18.9% more than if each budget had followed population growth plus inflation. This lack of consistent fiscal discipline has led to government excess contributing to higher taxes and slower economic growth. This is a reason—along with the need to tighten the fiscal belt like struggling families have had to do during the government-induced recession due to COVID-19—why the Legislature should pass a 2022-23 budget that is well below population growth plus inflation.

The Facts

- The Texas total state budget growth is estimated to be $37.3 billion or 18.9% higher in the 2020-21 budget than if each budget had increased by only population growth plus inflation since the 2004-05 budget.

- This translates into Texas families of four paying, on average, about $2,500 more this year in higher taxes to fund government than if the budget per capita had been frozen over time.

- Fortunately, the Texas Legislature has slowed the average growth of initial appropriations over the last three budgets after we created the CTB in 2015, compared with the average growth over the prior six budgets and compared with population plus inflation.

Recommendations

- Pass a 2022-23 Texas budget that remains within the Conservative Texas Budget threshold of:

- A 5.0% maximum increase in initial appropriations for the 2022-23 all funds budget.

This is based on Texas’s population growth plus the U.S. consumer price index inflation over fiscal years 2019 and 2020. - A $246.8 billion maximum amount of initial appropriations for the 2022-23 all funds budget.

This excludes extraordinary one-time appropriations and is 5% above the 2020-21 initial appropriations of $235.0 billion, which excludes property tax relief and funds for Hurricane Harvey recovery efforts.

- A 5.0% maximum increase in initial appropriations for the 2022-23 all funds budget.

- Eliminate wasteful expenditures to reduce the state’s budget like Texas families do during lean times.

Resources

2022-23 Conservative Texas Budget by Vance Ginn, Rod Bordelon, and Talmadge Heflin, Texas Public Policy Foundation (Sept. 2020).

2020 Real Texas Budget by Vance Ginn, Rod Bordelon, and Talmadge Heflin Texas Public Policy Foundation (Forthcoming 2020).

SB 1891: Let People Prosper by Limiting Government Spending by Vance Ginn, Texas Public Policy Foundation (April 3, 2019).