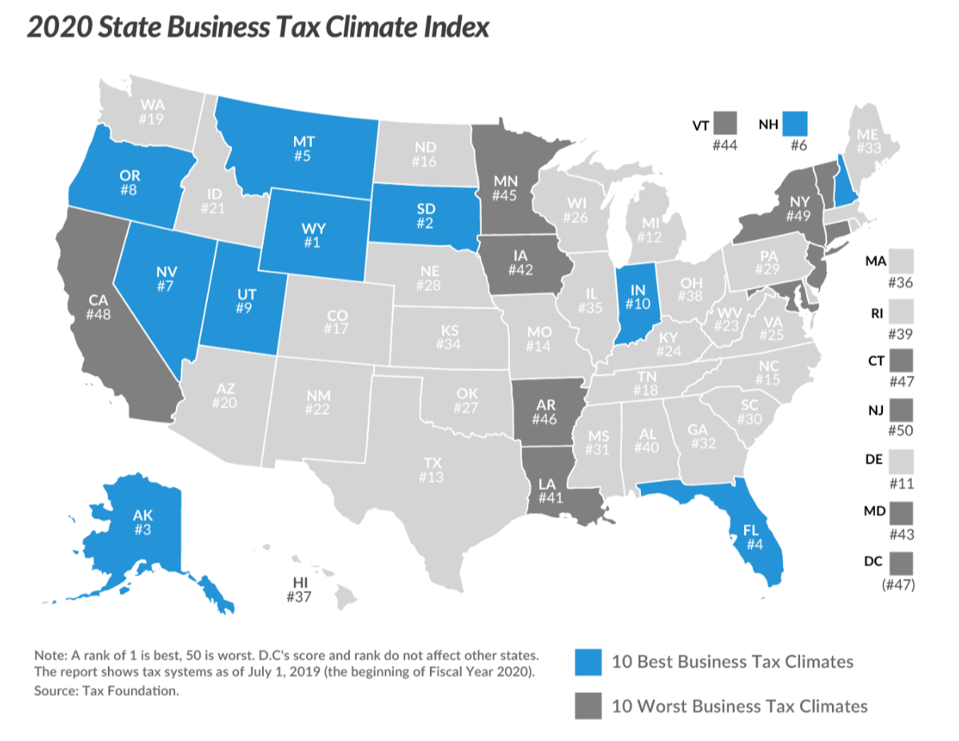

The Tax Foundation’s 2020 State Business Tax Climate Index illustrates the states’ relative business … [+]

THE TAX FOUNDATION

The 27 states with the lightest tax burden on individuals continued to add jobs at double the rate of the 23 states with higher taxes since the federal tax cut was signed into law in December 2017. This, according to new state-level employment numbers released by the U.S. Bureau of Labor Statistics.

The Tax Cuts and Jobs Act cut taxes for most Americans, but in high-tax states, many higher income individuals received a smaller tax cut than similarly situated peers in low-tax states, such as Texas or Florida. This is because the new tax law limited state and local tax (SALT) deductions to $10,000 per filing household. Limiting SALT deductions had an economic effect analogous to changing the tax code in all 50 states at once.

From December 2017 through last month, the 27 low-tax states grew their private sector payrolls by 3.90%. In the 23 high-tax states growth was only 1.86%. Low-tax states had a 109% advantage in the rate of private sector job growth over high-tax states.

In late September, a federal judge threw out a lawsuit against the Trump tax cut. The case, State of New York, et al v. Steven T. Mnuchin, contested the constitutionality of the $10,000 limit per filing household on state and local tax (SALT) deductions. New York’s Democratic Gov. Andrew Cuomo had previously complained that “The elimination of the SALT deduction (state and local tax) was an economic attack on Democratic states.”

In related state tax developments, The Tax Foundation, an independent tax policy nonprofit founded in 1937, issued its 2020 State Business Tax Climate Index today. This annual index analyzes state tax policy towards both small businesses, most often operated as sole proprietorships where the owners pay individual income taxes, as well as corporations. As a result, it looks at five separate taxes that constitute almost all of most business’ tax burden: corporate taxes, individual income taxes, sales taxes, property taxes, and unemployment insurance taxes.

Generally, the states that rank well in the Tax Foundation’s business tax survey have higher employment growth than the states that rank poorly. The average private sector job growth since the Tax Cuts and Jobs Act was went into effect in December 2017 was 3.4% for the ten highest rated states in the Tax Foundation index: Wyoming, South Dakota, Alaska, Florida, Montana, New Hampshire, Nevada, Oregon, Utah and Indiana. The ten lowest rated states—Louisiana, Iowa, Maryland, Vermont, Minnesota, Arkansas, Connecticut, California, New York, and New Jersey—saw their private sector payrolls expand by 1.5%, less than half as fast on average.

Many factors go into employment growth, including tax rates and policy, the regulatory burden, the lawsuit climate, labor and land costs, availability of skilled labor, infrastructure as well as interest rates and international trade. All things being equal, taxes do matter, especially over the long term, in determining where job-creating dollars flow.