On Monday, Dripping Springs ISD, a small school district just west of Austin, formally adopted its tax rate and set in motion a major tax increase.

On a vote of 6-1, the DSISD board approved a total tax rate of $1.3103 per $100 of assessed value (M&O rate: $0.9603 per $100 of value/I&S rate: $0.35 per $100 of value) which will push the average area homeowner’s tax bill up from $5,167 last year to $6,126 this year. That’s about a $1,000 jump in school taxes.

Such a hefty increase is significant; but what makes this small town tax hike worth elevating to a broader audience is a point raised by DSISD board trustee Stefani Reinhold, who would later be the lone ‘No’ vote on the tax rate.

While trying to persuade her colleagues to go easy on taxpayers, Reinhold questioned why the district had so much money set aside for a rainy day.

More from Community Impact:

“Reinold also expressed concern over the district’s fund balance—the amount of money it keeps in reserve. The district’s fund sits at about $39 million, according to the board.”

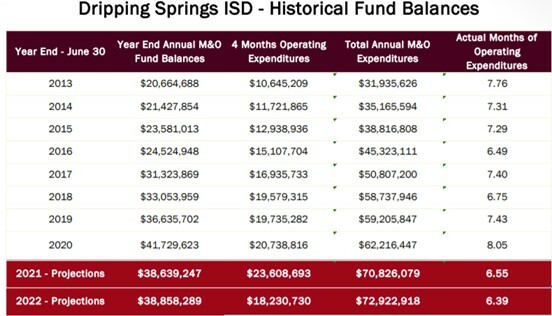

Her concern was a legitimate one. Dripping Springs ISD’s $39 million fund balance is substantially above its own self-imposed reserve requirement of “four months” worth of operating expenditures. In fact, a four-month reserve totals just $18.2 million, per the district’s newly-adopted budget. That’s quite a delta between what it has socked away vs. what it is actually on-hand.

Which raises the question: Why is the district hoarding taxpayer money?

That much isn’t clear. But if DSISD’s latest Comprehensive Annual Financial Report (CAFR) is any indication, then there may not be much of a reason, other than accumulating funds for the sake of accumulating funds.

On page 11 of the district’s 2020 CAFR, its auditors note: “The general fund is the primary operating fund of the District. At year-end, unassigned fund balance of the general fund was $39,244,937, while total fund balance was $41,729,623.”

Did you catch that? Its total fund balance was $41.7 million in 2020, of which $39.2 million was deemed as unassigned. And just what does that mean?

An unassigned fund balance refers to “amounts that have not been assigned to other funds and are neither restricted, committed, nor assigned for a specific purpose within the general fund.” In other words, the funds were not obligated in any fashion.

Thus, if the political will had existed in 2020, DSISD could have returned some portion of the unassigned fund balance back to taxpayers in the form of lower taxes, reduced fees, or less debt. Assuming nothing has changed, the same hypothetical should be true today too.

Districts hoarding money for the sake of hoarding money is not a problem unique to DSISD. It’s actually a big and growing problem statewide.

In April, the Foundation published a short article highlighting the “goldmine” that Texas ISDs have at their disposal and called attention to House Bill 3445, which would have required school districts to out some of those funds to work.

More from the article:

“Over the last decade of working on public school finance it has come to our attention that there has been a noticeable upward trend in district fund balances. Recent estimates indicate that districts have $6.6 billion over 110 days and $1.9 billion over 180 days of operating expenses in their fund balances.” [emphasis mine]

That’s right, Texas ISDs have amassed a cumulative fund balance of $6.6 billion above 110 days’ worth of operating expenses. The collective reserve is even greater when considered in full—it’s sitting at $21.5 billion in total.

It’s anyone’s guess why school districts have stockpiled so much money, but the fact is that they have. It’s about time that Texans began demanding the return of these funds, both at the state and local levels.

It’s urgent that we get this money back to taxpayers. Especially since school districts, like DSISD as well as others, show no sign of letting up on the tax increases.