Recently, the Texas Public Policy Foundation published a new report looking at property taxes in Texas’ major urban centers. In the report, the authors, Anthony Jones and James Quintero, compared property tax levy growth with population and inflation increases over a five-year period for select communities. The facts and figures are aimed at helping taxpayers better understand the tax burden in their area.

Houstonians have become increasingly aware of rising property taxes. But what has not been as clearly understood is that local property taxes are growing faster than the average taxpayer’s ability to pay for them at the city, county, and school district levels.

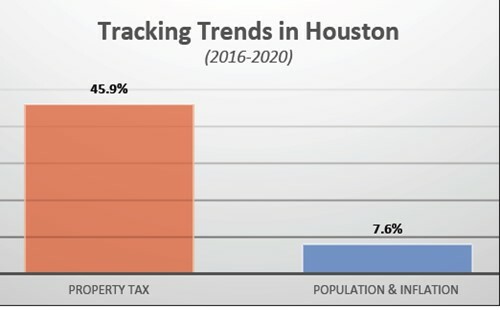

The report finds that from 2016 to 2020, the city of Houston’s population (corporate boundaries only) shrank from 2,309,544 to 2,304,580, representing a 0.2% decrease. At the same time, inflation increased just 7.8%. However, Houston’s property tax burden has jumped by 45.9%. The visual below shows the discrepancy and suggests the need for greater fiscal restraint and judiciousness.

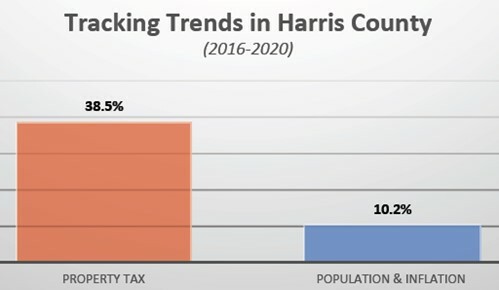

Similarly, Harris County’s tax burden is also a major cause for concern. From 2016-2020, the county’s tax levy increased from $1.8 billion to $2.4 billion, a growth of 38.5%. At the same time, inflation increased by 7.8% in addition to a modest 2.3% bump in population. The visual below shows the large gap.

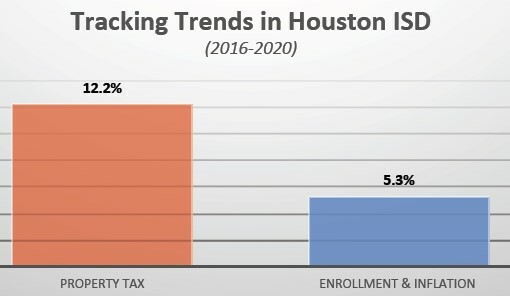

Finally, from 2016 to 2020, Houston ISD’s property tax levy increased from $2 billion to $2.2 billion, representing a growth of 12.2%. At the same time, the district’s student enrollment shrank from 215,627 to 210,061, equating to a 2.6% decrease. Inflation increased by 7.8%. Hence, Houston ISD’s property tax burden rose by 12.2% while its enrollment and inflation grew more slowly, at 5.3%.

The facts and figures are illuminating and show the need for more reforms on the property tax front.